Picture supply: Getty Pictures

These FTSE 250 shares look dust low-cost, on paper. Right here’s why I feel traders ought to give them critical consideration.

Hochschild Mining

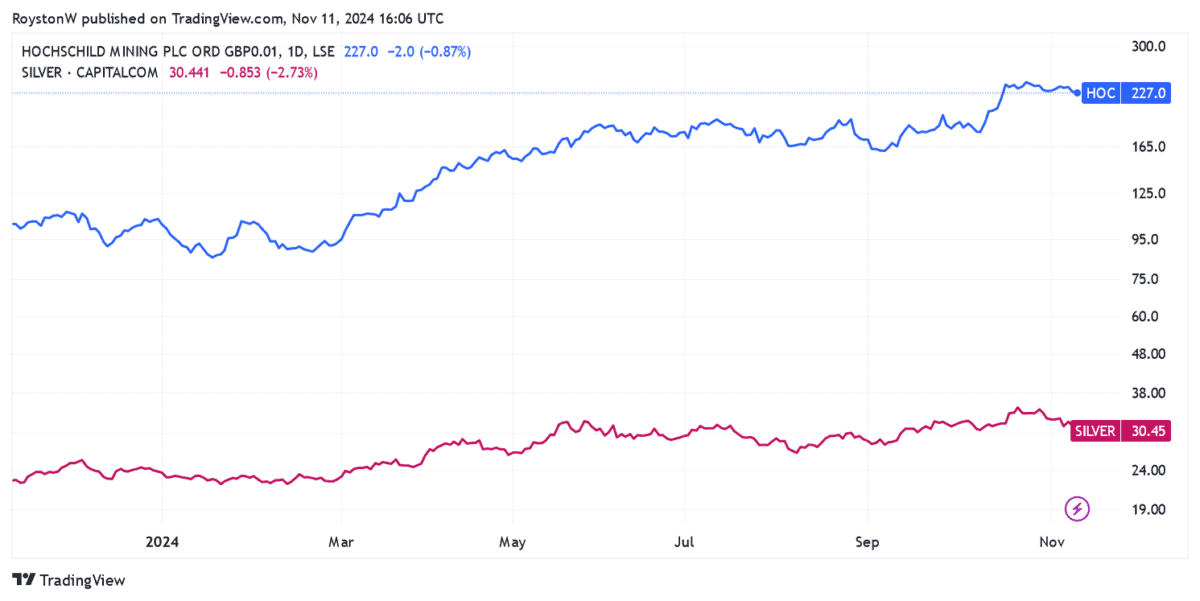

Silver shares throughout the globe have soared in worth amid exploding demand for the dear steel. At 227p per share, Hochschild Mining (LSE:HOC) for example is up 41% over the previous six months.

However rising steel demand’s solely half the story. You see, silver’s up by a extra modest 9% over the identical interval.

Hochschild’s outperformance displays a gentle string of spectacular manufacturing updates this 12 months. Its newest assertion in October confirmed silver and gold manufacturing up 4% and 21% respectively through the third quarter.

This was the strongest third-quarter efficiency for 5 years. It displays profitable ramping up of manufacturing at Hochschild’s Mara Rosa gold mine in Brazil, together with ongoing enchancment work on the Inmaculada flagship challenge in Peru.

Issues are trying good for the agency as silver demand heats up. Protected-haven gross sales are rising as rate of interest cuts gas inflation, and geopolitical uncertainty rises following this month’s US election. Silver consumption might additionally rise for industrial functions as the worldwide financial system improves.

But regardless of latest value beneficial properties, Hochschild shares nonetheless look dust low-cost to me. For 2025, they commerce on a price-to-earnings (P/E) ratio of simply 6.2 occasions.

Moreover, the South American miner additionally offers on a ahead price-to-earnings development (PEG) a number of of 0.1. Any studying under 1 implies {that a} share is undervalued.

Commodity costs are notoriously unstable. And a pointy silver retracement might play havoc with Hochschild’s revenues. However on steadiness, I feel it’s a pretty inventory to think about.

NCC Group

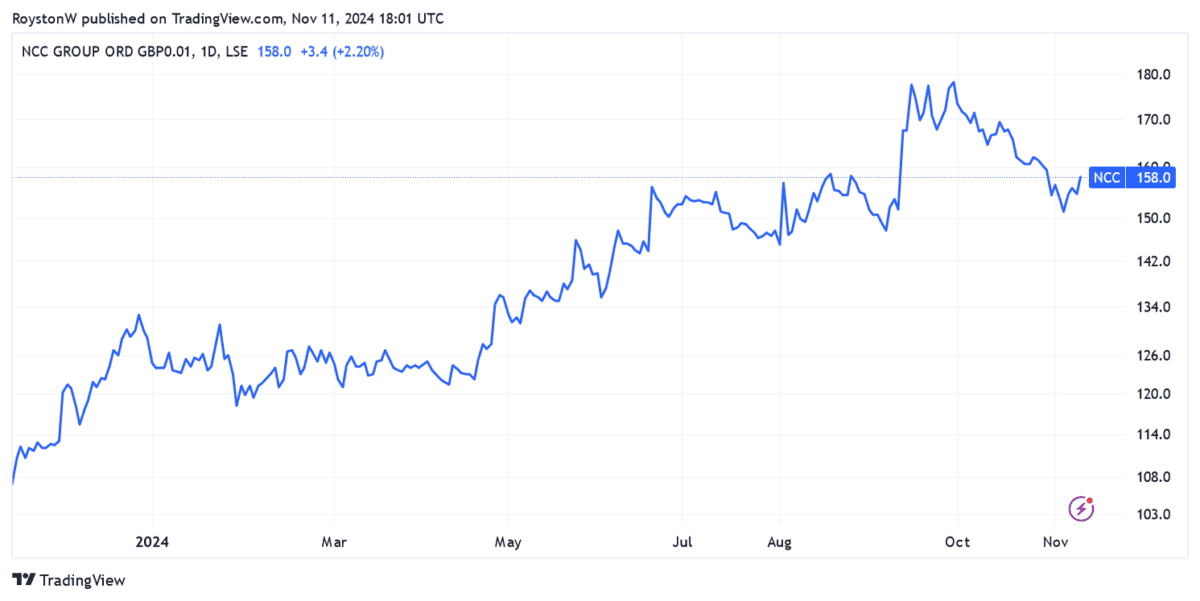

Like many tech shares, NCC Group (LSE:NCC) doesn’t look low-cost, primarily based on its potential P/E ratio. This stands at a meaty 20.5 occasions, above the FTSE 250 common of 14.5 occasions.

Nevertheless, a corresponding PEG a number of of 0.2 suggests the cybersecurity specialist is definitely buying and selling under worth.

NCC shares have risen a powerful 17% in six months, to 158p per share. Enterprise is recovering strongly following earlier issues within the US tech sector. And a sequence of forecast-beating buying and selling statements in 2024 have pushed its shares greater.

Newest financials confirmed gross sales up 4% between June and September, at £104m. This helped NCC swing to an adjusted working revenue of £6m from a £1m loss a 12 months earlier.

I feel gross sales ought to maintain rising too, pushed by a mix of falling rates of interest and the rising prevalence of cyber threats dealing with firms.

I’m additionally inspired by the route of NCC’s gross margins, which improved 200 foundation factors to 41.4% within the 12 months to Might. This mirrored profitable restructuring efforts and a greater product combine as managed companies gross sales elevated.

NCC has a market-cap of £486m. However it’s a small fish in contrast with US rivals like Palo Alto and Crowdstrike. These companies have considerably greater R&D budgets and higher model recognition, and subsequently pose a big risk.

However the fee of market development suggests NCC should still be an ideal inventory to think about. And particularly at present costs.