Picture supply: Getty Photos

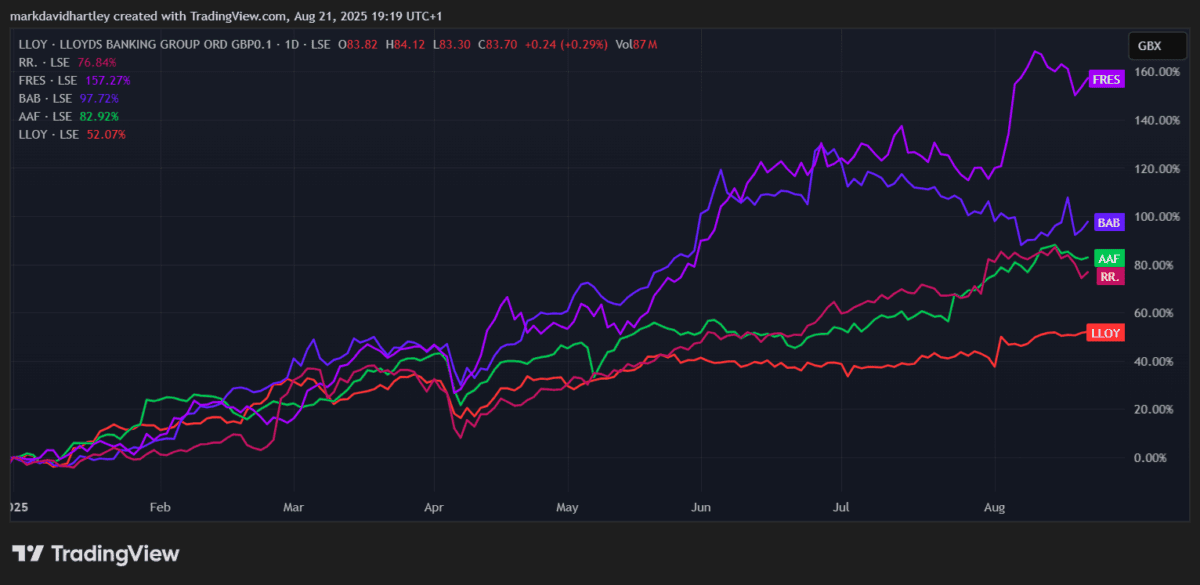

Lloyds‘(LSE: LLOY) shares continued their seemingly infinite climb this week, bringing their whole year-to-date good points to an astonishing 54%.

Solely a handful of FTSE 100 shares are doing higher, together with Fresnillo, Babcock, Airtel Africa and the ever-popular Rolls-Royce. Among the many banks, Lloyds is main the pack. NatWest and Barclays are up round 40%, whereas Normal Chartered has risen 37% and HSBC 24%.

That’s fairly the turnaround for a financial institution that not so way back was broadly seen as a serial underperformer.

A rushing prepare?

RBC Capital Markets just lately likened European banks to a “rushing prepare” in a analysis observe. That sounds thrilling, however the analysts additionally highlighted how weak the sector stays to geopolitical and macroeconomic shocks. Lloyds was amongst their favoured picks, joined by Deutsche Financial institution and OSB Group.

Goldman Sachs has additionally taken a extra bullish stance, elevating its value goal on Lloyds shares to 99p from 87p earlier this month. On common, 18 analysts now see the inventory heading to 90.7p over the following yr – round 8% larger than right now. Eleven analysts also have a Robust Purchase ranking, whereas eight are sticking with a Maintain.

It appears confidence is returning in a giant manner.

PayPoint partnership

One other promising growth is the information of Lloyds’ partnership with PayPoint. By means of the BankLocal service, the group’s clients will quickly have the ability to make money deposits at greater than 30,000 places throughout the UK.

Meaning easy and handy entry to pay in as much as £300 a day in notes and cash, with the cash exhibiting in accounts inside minutes. Importantly, Lloyds would be the first of the excessive avenue banks to completely embrace the scheme.

In an period the place financial institution branches are closing at a report tempo, it appears like a sensible transfer that might assist preserve buyer loyalty.

Dependable revenue… for now

Revenue stays an vital motive why many buyers purchase Lloyds shares. Nevertheless, the latest rally has pushed the dividend yield under 4% for the primary time in almost three years.

Nonetheless, dividends are rising. Forecasts counsel payouts might attain 4.7p per share by 2027 – a 48% enhance from right now’s 3.17p. Not dangerous in any respect, although historical past exhibits warning is required. When Covid struck, Lloyds slashed its dividend in half. If the same shock reoccurred, shareholders might face the identical disappointment.

Rates of interest and inflation additionally stay threat elements. A pointy change in both might hit the financial institution’s profitability arduous.

Nonetheless good worth?

All this progress has not gone unnoticed. Lloyds’ ahead price-to-earnings (P/E) ratio now sits at 11, which is larger than NatWest, HSBC and Barclays. Its debt-to-equity ratio can be notably larger than most of its friends.

That implies Lloyds would possibly now not be the discount it as soon as was. However whereas the very best good points might already be within the bag, I wouldn’t count on the expansion story to fade in a single day.

For long-term revenue buyers, Lloyds stays a sexy FTSE 100 choose to contemplate. The valuation is now not grime low cost, however with dividends set to rise and new companies like PayPoint partnerships including worth, there’s nonetheless a robust case for proudly owning this British banking big.