Picture supply: NatWest Group plc

It has been an excellent 12 months to personal shares in excessive road financial institution NatWest (LSE: NWG). The share worth has surged 65% throughout the previous 12 months. Not solely that, it yields 4.9% even after that worth improve.

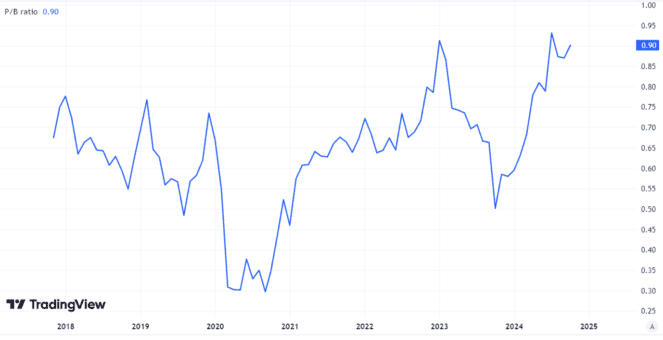

However with a price-to-earnings ratio of seven, the NatWest share worth nonetheless seems low cost on that measure. As earnings are usually not all the time the easiest way to worth financial institution shares, I additionally think about price-to-book worth when weighing whether or not so as to add them to my portfolio.

On that foundation too, NatWest shares seem pretty low cost given its sturdy manufacturers, massive buyer base and confirmed profitability. They arrive in at round 0.9, which is cheaper than the honest worth of 1.

Created utilizing TradingView

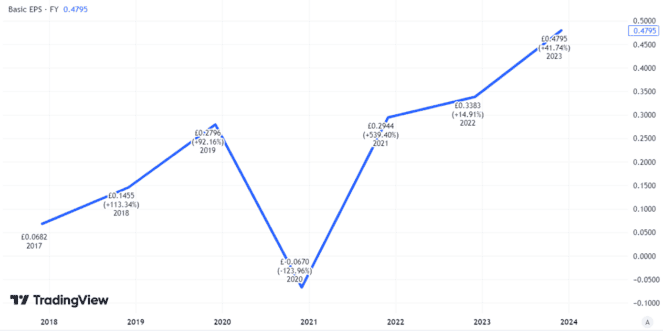

Financial institution earnings can transfer round lots

The problem with ebook worth or earnings as a valuation metric when assessing financial institution shares is that each can change, typically in a short time.

If the property market all of the sudden crashes or family earnings contracts sharply, the variety of debtors that fall behind on their repayments can improve. That may result in decrease earnings or perhaps a transfer from revenue into the pink.

Created utilizing TradingView

If property costs fall, a financial institution’s ebook worth will probably additionally fall. In any case, that worth is predicated on the property (corresponding to mortgaged buildings) that it carried on its books. So decrease property costs can imply a decrease ebook worth.

For now, there isn’t any quick signal that both is about to occur on a big scale. However on a longer-term timeframe, I really feel much less assured. The economic system stays lacklustre, whereas property costs stay excessive by long-term historic affordability measures.

Restricted provide and robust demand may also help help costs, however even when demand outstrips provide, property costs can fall if householders battle to pay for them.

The place issues may go from right here

That may be a danger that weighs on my thoughts proper now in terms of the share worth of British banks, together with NatWest. Certainly, it’s a key purpose that I don’t personal the share in the meanwhile and haven’t any plans so as to add it into my portfolio.

The federal government promoting down its stake within the financial institution (a legacy of a monetary disaster period bailout) appears to not have damage the NatWest share worth and from a valuation perspective the financial institution nonetheless seems pretty low cost.

In the meantime, the longer the enterprise continues to carry out properly, the extra assured I reckon some traders will really feel {that a} onerous financial touchdown is a falling danger. On that foundation, I believe that even after their current run, NatWest shares might hold transferring up from right here.

I might not be stunned to see them at the next worth a 12 months from now, though I don’t suppose the enterprise efficiency justifies something like one other 65% rise in share worth within the coming 12 months.

Regardless of that optimism although, I’ll stay on the bench till there’s clearer proof of ongoing sturdy efficiency within the international economic system and the UK.