Picture supply: Getty Photos

Shares in Coca-Cola HBC (LSE:CCH) have fizzed greater on Thursday (13 February) on an in any other case flat day for the FTSE 100 share index.

At £31.98 per share, the drinks bottler has leapt 7.7% to steer the UK blue-chip index greater. A forecast-topping set of financials for the final calendar yr helped it rise.

Are Coca-Cola HBC shares ‘The Actual Factor’ for development traders? Let me provide the lowdown.

Sturdy numbers

The enterprise bottles, sells, and distributes merchandise for heavyweight drinks manufacturers like Coke, Fanta, and Sprite. Their enduring reputation, mixed with their sturdy data of innovation, help wholesome gross sales development even throughout financial downturns.

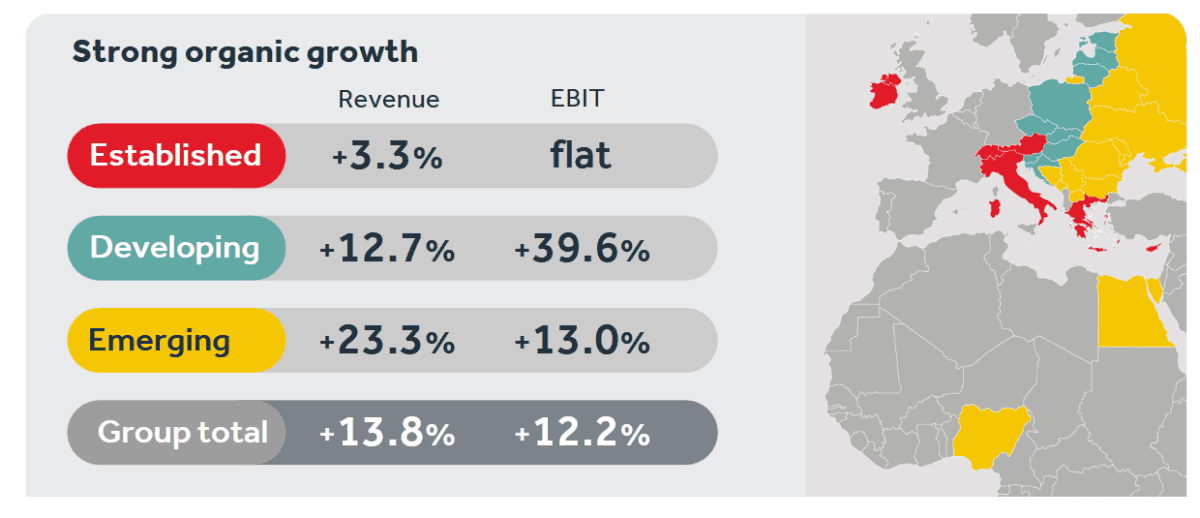

In 2024, the agency, which provides its drinks throughout a lot of Europe and elements of Africa, reported natural web gross sales development of 13.8%, to €10.8bn.

Coca-Cola HBC isn’t nearly delicate drinks, although. Certainly, the agency’s power and occasional merchandise stole the present once more in 2024. Volumes throughout these classes soared 30.2% and 23.9% yr on yr.

Tasty worth

Coca-Cola HBC shares have been one of many FTSE 100‘s largest success tales to date in 2025. They’re up 14.8% since 1 January versus the broader index’s 5.7% enhance.

But regardless of this, the corporate nonetheless presents good worth in comparison with the Footsie’s different main shopper items makers.

It’s ahead price-to-earnings (P/E) ratio is 15.3 occasions, which is decrease than Unilever and Diageo‘s corresponding readings of 17 occasions and 16.3 occasions, respectively. Its P/E a number of can also be roughly in step with Reckitt Benckiser‘s for 2025.

Coca-Cola HBC’s valuation is all of the extra engaging given its superior buying and selling momentum versus these different FTSE shares (Unilever’s share value truly slumped Thursday after it predicted delicate first-half gross sales).

A prime development share?

I’m not saying that Coca-Cola HBC is completely danger free, after all.

The difficult financial panorama continues to solid a shadow, and the corporate has mentioned it expects natural income development to sluggish sharply, to six%-8% in 2025.

Natural earnings (earlier than curiosity and tax), in the meantime, is tipped to extend by 7%-11% this yr, down from 12.2% final yr.

A large geographic footprint additionally leaves the corporate susceptible to overseas change pressures. This proved the case final yr as, on a reported foundation, gross sales rose by a extra modest (but nonetheless respectable) 5.6%.

However context is all the pieces, and people numbers are nonetheless fairly good within the present surroundings. It displays largely Coca-Cola HBC’s large publicity to fast-growing areas: gross sales in its rising and creating markets jumped by double-digit percentages in 2024.

Sturdy development can also be anticipated because the bottler executes its development priorities. It plans to seize a bigger share within the out-of-home espresso market, whereas additional product launches within the power class are doubtless (Monster Vitality Inexperienced Zero was launched in one other 16 territories final yr).

Metropolis analysts count on group earnings to develop 11% in 2025 and one other 10% subsequent yr. Given its market-leading labels, huge regional footprint, and robust file of innovation, I believe it’s one of many hottest FTSE 100 development shares to think about right now.