Later right now, US President Trump will have fun what he refers to as Liberation Day by persevering with with a tariff coverage to cut back American reliance on international merchandise. Relying on the severity of the tariffs, the home crypto-mining trade will undergo appreciable losses.

In an interview with BeInCrypto, Matt Pearl, director of the Strategic Applied sciences Program on the Middle for Strategic and Worldwide Research (CSIS), defined that levies on China will inherently disrupt provide chain dynamics and enhance operational prices for the US mining trade.

How Will Liberation Day Tariffs Impression Mining Prices?

Later right now, Trump is anticipated to unveil sweeping tariffs on US imports as a part of an financial agenda he denominated as Liberation Day. Nonetheless, particulars on how aggressive they are going to be or which nations shall be most focused have been lackluster.

The absence of data surrounding the occasion has left the better public at the hours of darkness, guessing what’s going to occur subsequent. Within the case of the US mining trade, members will watch Trump’s bulletins concerning China.

A bit over a month in the past, the Trump administration slapped a brand new 10% tariff on items from China on prime of the prevailing 10% tariff it had enacted solely weeks earlier than. Throughout his marketing campaign path, Trump even proposed as much as 60% border taxes on Chinese language items.

If Trump applies additional levies on China in gentle of Liberation Day, American Bitcoin miners should make many selections concerning the character and scale of their future operations.

ASIC {Hardware}: The Essential Import

Crypto mining closely depends on Utility-Particular Built-in Circuit (ASIC) tools. These laptop chips are constructed to carry out the advanced mathematical calculations required to validate transactions and mine new cash. They’re significantly indispensable in Bitcoin and different proof-of-work cryptocurrencies.

ASICs have grow to be the dominant {hardware} in Bitcoin mining because of their superior efficiency over different varieties of {hardware}, resembling CPUs or GPUs. They provide a a lot greater hash charge per unit of power consumed and are designed for particular mining algorithms.

“It’s an extremely R&D-intensive course of to create an ASIC that’s power environment friendly and does every part you want within the context of Bitcoin mining,” Pearl defined.

The US closely depends on imports of ASIC mining {hardware}, with a considerable portion coming from China. China, the US’s longtime commerce rival, has well-established manufacturing capabilities for producing superior semiconductor chips.

American Reliance on Chinese language {Hardware} Gear

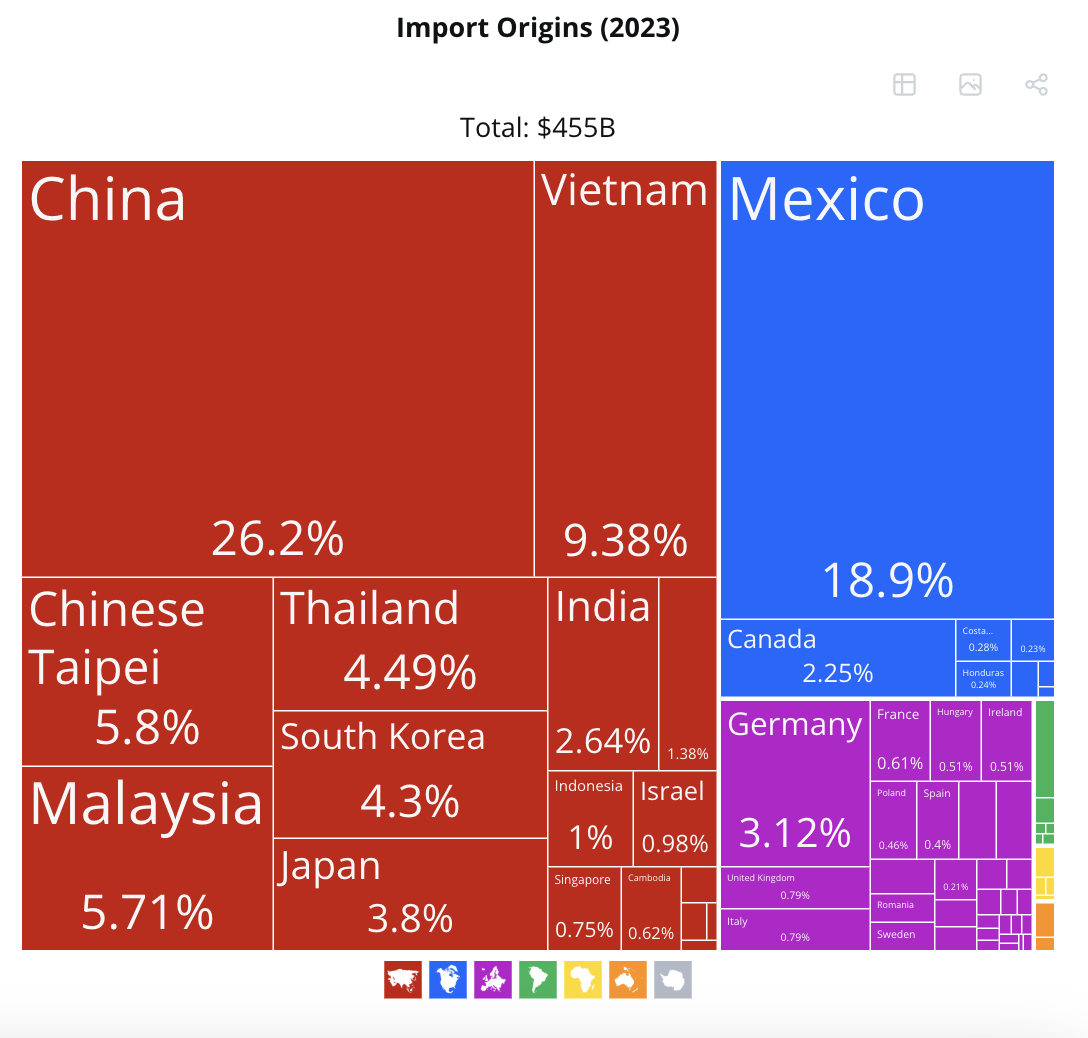

In accordance with the information from the Observatory of Financial Complexity (OEC), in 2023, the USA grew to become the world’s largest importer {of electrical} equipment and electronics. That 12 months, it imported $455 billion value of {hardware}, resembling built-in circuits (ASICs), semiconductor units, and electrical transformers.

The US imports the most important quantity {of electrical} equipment from China. Supply: OEC.

Electrical equipment and electronics have been recorded because the second-largest import class, with China supplying $119 billion of that complete, comfortably consolidating its place because the US’s prime vendor.

In January 2025 alone, the USA’ Electrical equipment and electronics exports accounted for as much as $19 billion, and imports amounted to $41.3 billion, with most imports coming from China.

Provided that the US closely is determined by China for this specialised {hardware}, any tariffs imposed on digital imports from China would straight have an effect on the price of ASIC mining {hardware} within the US.

Although much less extreme, Trump’s tariff insurance policies throughout his first time period in workplace provide a glimpse into their potential impression on cryptocurrency miners.

Classes from Trump’s First Time period

In June 2018, the USA Commerce Consultant beneath Trump reclassified Bitmain, a Chinese language Bitcoin mining {hardware} maker, from a “knowledge processing machine” to an “electrical equipment equipment.” Bitmain, particularly its “Antminer” collection, is a number one producer of ASIC mining {hardware}.

By reclassifying the {hardware}, a 2.6% tariff was added to the prevailing 25% tariff on Chinese language items. This successfully raised the whole tariff on US shipments for Chinese language crypto mining tools to 27.6%.

Mining {hardware} prices are one of many largest enter prices operators within the American mining enterprise face. Following the tariff hike, crypto miners inevitably noticed their manufacturing prices enhance considerably.

The present cumulative 20% tariffs on Chinese language items and the potential for additional will increase after Trump’s Liberation Day bulletins counsel an identical or extra extreme impression.

“Within the brief to medium time period, [the US mining industry] is extraordinarily weak, significantly as a result of a lot of the Bitcoin mining tools is coming from China. ASICs should not simple to provide, and so it’s going to lift the value of Bitcoin mining tools within the US. It did in 2018 when Trump imposed tariffs in his first time period, and it’ll be much more vital this time,” Pearl instructed BeInCrypto.

Except for elevated prices, tariffs may also trigger a disruption in provide chain dynamics for mining {hardware}.

Provide Chain Disruptions: A Looming Menace

In accordance with Pearl, US crypto miners can anticipate delays and shortages in mining {hardware} if Trump applies additional tariffs on China. His judgment is especially based mostly on the truth that that is already occurring.

“We’re already seeing delays. We’ve already seen Customs and Border Patrol taking longer to look at the tools and clear it by customs, and you then additionally had the US Postal Service that had very quickly halted bundle shipments from China,” Pearl defined.

Two months in the past, the US Postal Service (USPS) introduced that it had quickly suspended bundle deliveries from China shortly after Trump imposed 10% tariffs on Chinese language imports. USPS clarified that the suspension stemmed from eradicating an exemption permitting duty-free, inspection-free shipments beneath $800.

“The USPS and Customs and Border Safety are working intently collectively to implement an environment friendly assortment mechanism for the brand new China tariffs to make sure the least disruption to bundle supply,” the Postal Service stated in an announcement.

The suspension, nonetheless, was reversed lower than 24 hours later. But, with new tariffs on the horizon, an identical state of affairs can play out, threatening to backlog mining plans for American Bitcoin miners.

“As soon as [Trump] imposes the tariffs it’ll be much more vital by way of, it’ll increase prices, it’ll depress the quantity that’s despatched, after which it’ll increase uncertainty about whether or not the Customs and Border Patrol or others will gradual issues down once they do get to the US. It’s more durable for firms to have assurance about once they’ll have the ability to really start mining,” Pearl added.

If tariffs persist, US crypto mining firms would require appreciable long-term restructuring.

Will US Miners Relocate As a result of Tariffs?

Although there’s no proof that American crypto mining firms relocated because of Trump’s tariff coverage throughout his first presidency, this selection is a believable consequence this second time round.

“I believe the distinction this time is that there’s much more uncertainty. The President appears to be way more targeted on tariffs and to this point, evidently there’s an absence of permanence to the administration’s choices. There’s an imposition of tariffs, however then they’ll alter them or enhance them, so I believe that there’s simply much more uncertainty than there was within the first administration. That’s what would make it totally different, by way of seeing extra relocation of the mining trade elsewhere, outdoors of the US,” Pearl instructed BeInCrypto.

Clara Chappaz, France’s Digital Minister, recommended monetizing EDF’s surplus power by Bitcoin mining this week. EDF is the nation’s largest state-owned power firm. In accordance with Chappaz, this strategy may assist scale back the corporate’s debt. Many within the broader crypto group celebrated the thought.

If Europe surrenders itself to those methods, may American firms really feel extra inclined to maneuver their operations overseas? Pearl says sure, however Europe will not be the area of choice.

“I believe the countervailing factor is that labor prices are dearer in Europe. There could be a lot extra pink tape in allowing and really constructing the infrastructure. I ponder if there are different regulatory and labor obstacles that may make a shift to Europe much less seemingly than a shift to different components of Asia,” he stated.

Nonetheless, easy relocation gained’t eradicate the necessity for entry to a constant ASIC provide.

An Unlikely Consequence

Thus far, no nation has been capable of produce ASICs to the dimensions and pace that China has. It may additionally be in China’s greatest curiosity to relocate its operations to the USA.

“It’s doable that a number of the Chinese language firms that produce this tools will really find manufacturing capability within the US in order that they aren’t topic to the tariffs. However that includes relocating amenities and getting permits. It’s one thing that takes time, and it’s not going to occur tomorrow,” Pearl stated.

Nonetheless, given the hostility between the 2 nations, this appears unlikely.

In the end, home manufacturing presents the perfect path to US self-sufficiency. Nonetheless, it will likely be a fancy –and prolonged– course of.

Bringing Operations Onshore

Underneath Biden, Congress permitted the CHIPS and Science Act in July 2022. This laws was designed to spice up home semiconductor manufacturing in the USA.

Although it doesn’t explicitly single out ASIC tools, its provisions strongly encourage and incentivize the relocation and institution of all varieties of semiconductor manufacturing inside US borders, together with these associated to ASICs.

“If the [Trump] administration doesn’t attempt to undo a few of what was executed beneath the CHIPS Act by way of shifting manufacturing capability to the US, it’s doable that over the course of the following a number of years, US firms will develop ASICs which are aggressive. However that’s a long-term challenge– it’s not a simple factor to develop these chips,” Pearl instructed BeInCrypto.

Two days in the past, Hut 8, a significant North American Bitcoin mining firm, partnered with Eric Trump to launch American Bitcoin, aiming to show it into the world’s largest pure-play miner.

Whereas this initiative aligns with President Trump’s aim of bringing manufacturing again to the US, Hut 8, like different American miners, depends on ASIC {hardware}. This creates a possible battle along with his tariff insurance policies.

Within the interim, US miners should grapple with the prevailing reliance on Chinese language ASICs.

American firms will proceed to bear the impression of Trump’s tariffs on essential Chinese language crypto mining {hardware}. This can final till the US can effectively onshore broader manufacturing and manufacturing.

If Trump’s Liberation Day bulletins contain additional tariffs on China, home mining firms, massive or small, will see manufacturing prices rise considerably. Disturbances in tightly interrelated provide chain dynamics may also disrupt their operations. How they reply has but to be decided.