IREN (NASDAQ: IREN) simply grew to become yet one more publicly-listed Bitcoin (BTC) miner from Wall Road, which considerably elevated its income over the past 12 months, benefiting from larger cryptocurrency costs. In keeping with the outcomes for the fiscal 12 months ended June 30, 2024, revenues grew by 145%, and the variety of mined BTC elevated by 30%.

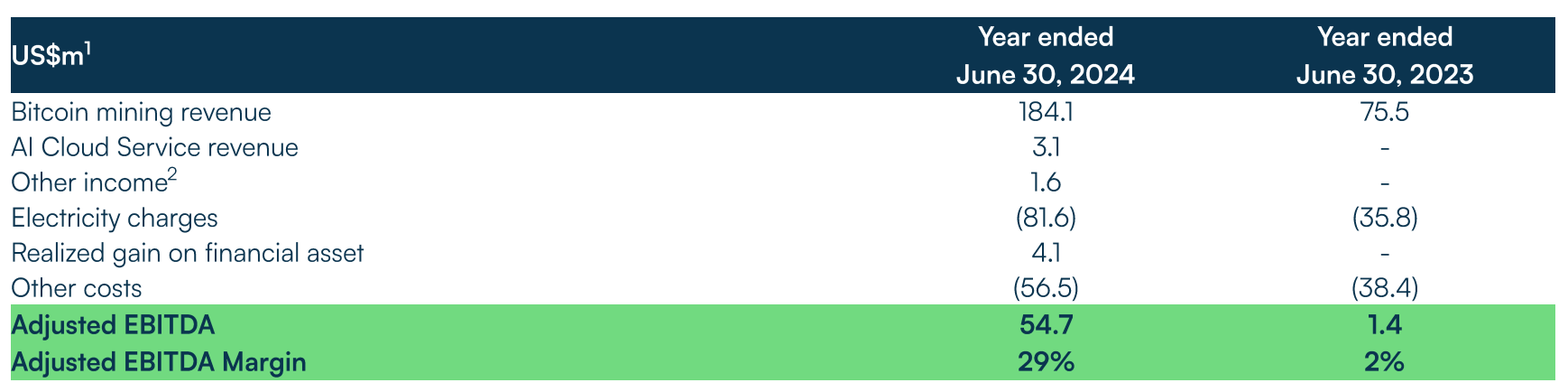

The corporate reported file Bitcoin mining income of $184.1 million, up from $75.5 million within the earlier fiscal 12 months. This substantial improve was pushed by development in working hashrate and better Bitcoin costs. IREN mined 4,191 Bitcoin in the course of the 12 months, in comparison with 3,259 in fiscal 12 months 2023.

Adjusted EBITDA additionally noticed a robust enchancment, reaching $54.7 million, up from $1.4 million within the prior 12 months. The corporate’s EBITDA turned optimistic at $19.6 million, in comparison with a lack of $123.2 million in fiscal 12 months 2023.

Consequently, the web lack of almost $172 million from the earlier 12 months was lowered to $29 million.

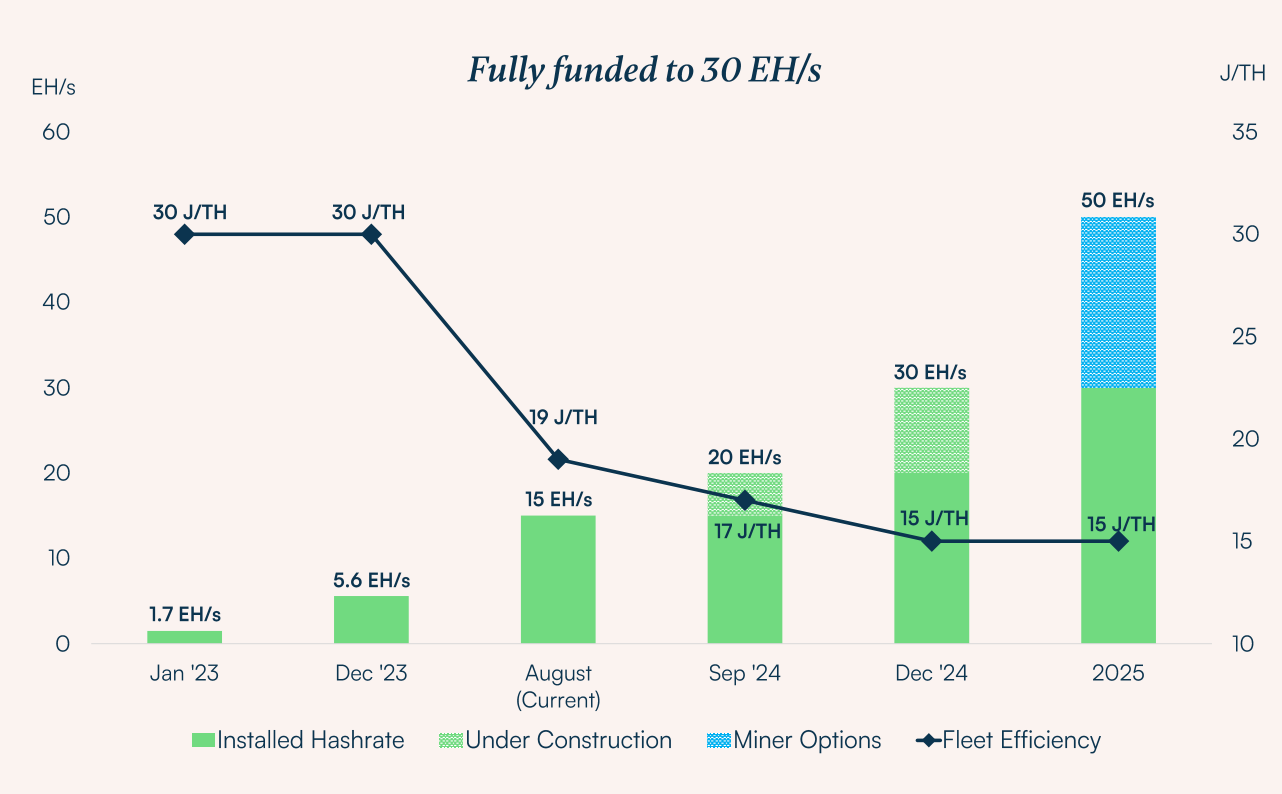

“We’re happy to report our full 12 months FY24 outcomes, which highlights continued development throughout income, earnings and cashflow,” mentioned Daniel Roberts, Co-Founder and Co-CEO of IREN. “Our 2024 steering stays unchanged. With 15 EH/s put in, we’re effectively on monitor to realize our 20 EH/s milestone subsequent month and 30 EH/s this 12 months.”

Among the many firms that not too long ago reported income development can be Argo Blockchain. Its monetary outcomes grew by 18% in H1 2024 regardless of a 50% drop within the variety of mined cryptocurrencies

AI Transfer

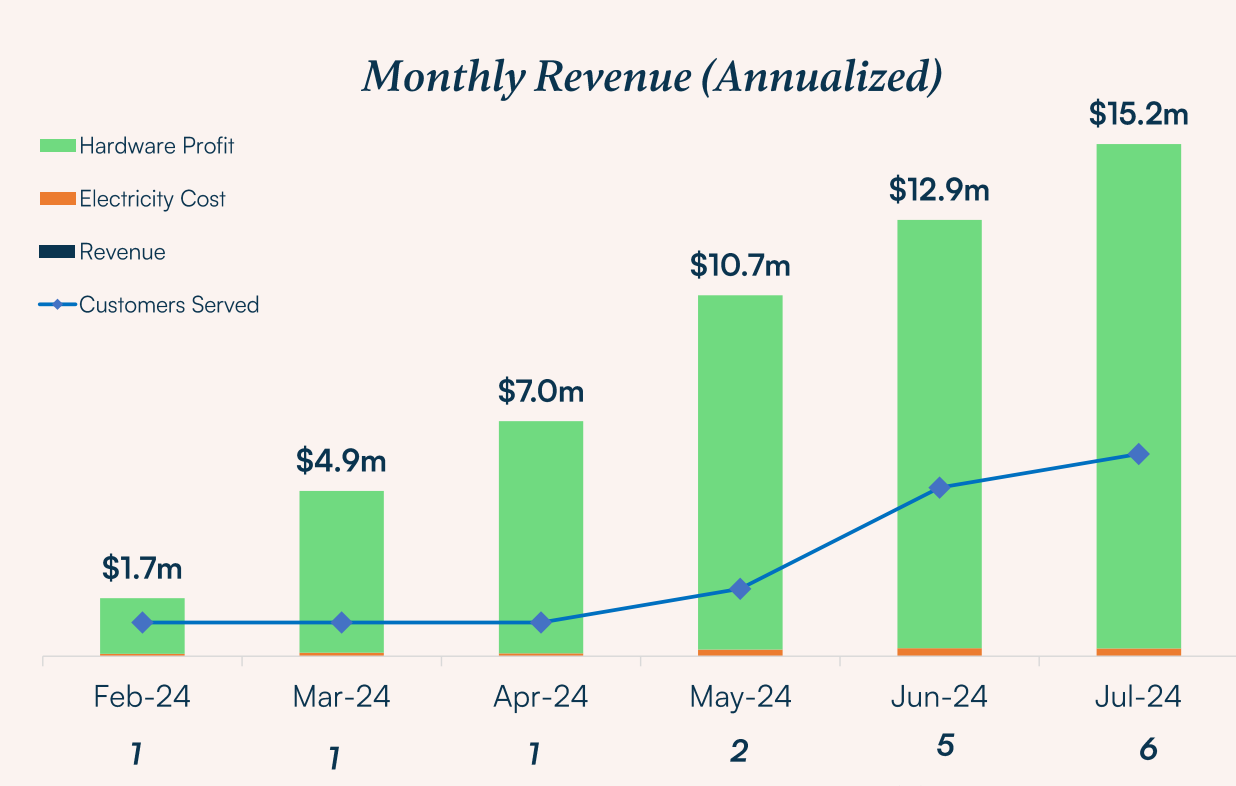

Equally to a lot of different firms within the sector not too long ago, IREN additionally reported progress in its AI Cloud Companies enterprise, producing $3.1 million in income from a number of clients throughout reserved and on-demand markets.

The corporate’s growth plans stay on monitor, with knowledge heart capability anticipated to succeed in 510MW by the top of 2024. IREN has additionally secured 2,310MW of grid-connected energy over the past 12 months, positioning it for future development.

Trying forward, IREN is about to extend its Bitcoin mining capability to 30 EH/s by the top of 2024, with 15 EH/s already put in. The corporate has additionally secured a pathway to succeed in 50 EH/s by way of current buy choices for Bitmain S21 Professional miners.

Good outcomes are one factor, nevertheless, Bitcoin mining gigants from Wall Road nonetheless really feel the halving hangover. Their mining revenues in July fell by one other 12%. This continues the destructive response to April’s halving, which lowered block rewards, coupled with low community charges and rising manufacturing prices. In keeping with the newest JPMorgan report, that is making it troublesome for miners to keep up profitability.