Picture supply: Getty Photos

Reaching monetary freedom with an ISA is a laudable intention. Nevertheless, acquiring a yearly passive revenue of £18,000 in retirement might be difficult for many as a result of they don’t maximise the chance of getting their hard-earned cash to work for them.

Money ISAs are king

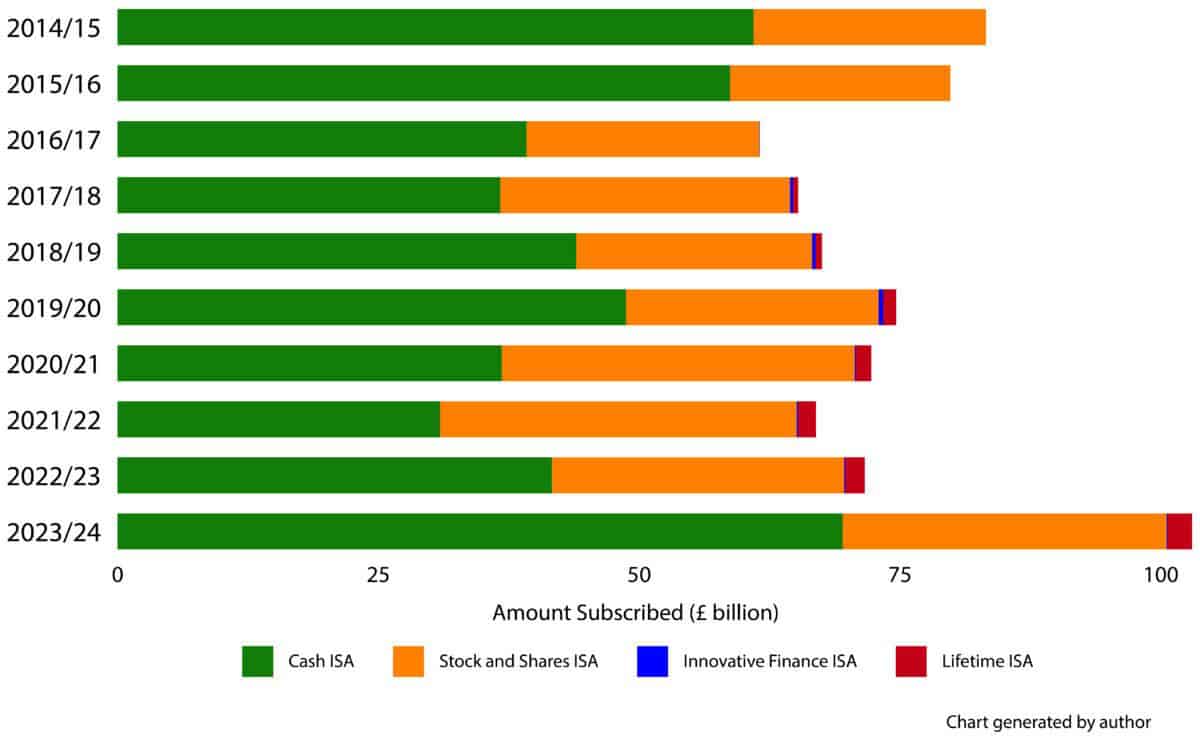

Within the final monetary 12 months, for each new Shares and Shares ISA opened, an equal of two.42 Money ISAs was opened. Much more starkly, of a complete ISA financial savings market of £103bn, over two-thirds are stashed in Money ISAs. The total breakdown is proven within the chart beneath.

Information supply: HMRC

In my view, this weighting is skewed incorrectly. Right now, the common Money ISA yields about 4%. However, over the long run, the FTSE 100 has generated common annualised returns of 6.5% and the S&P 500, 10.5%.

Compounding beneficial properties

A person on the lookout for a second revenue of £1,500 a month at retirement might want to have accrued an ISA pot value £450,000. However due to the magic of compounding, small modifications in annual proportion returns add as much as big variations when measured over a long time.

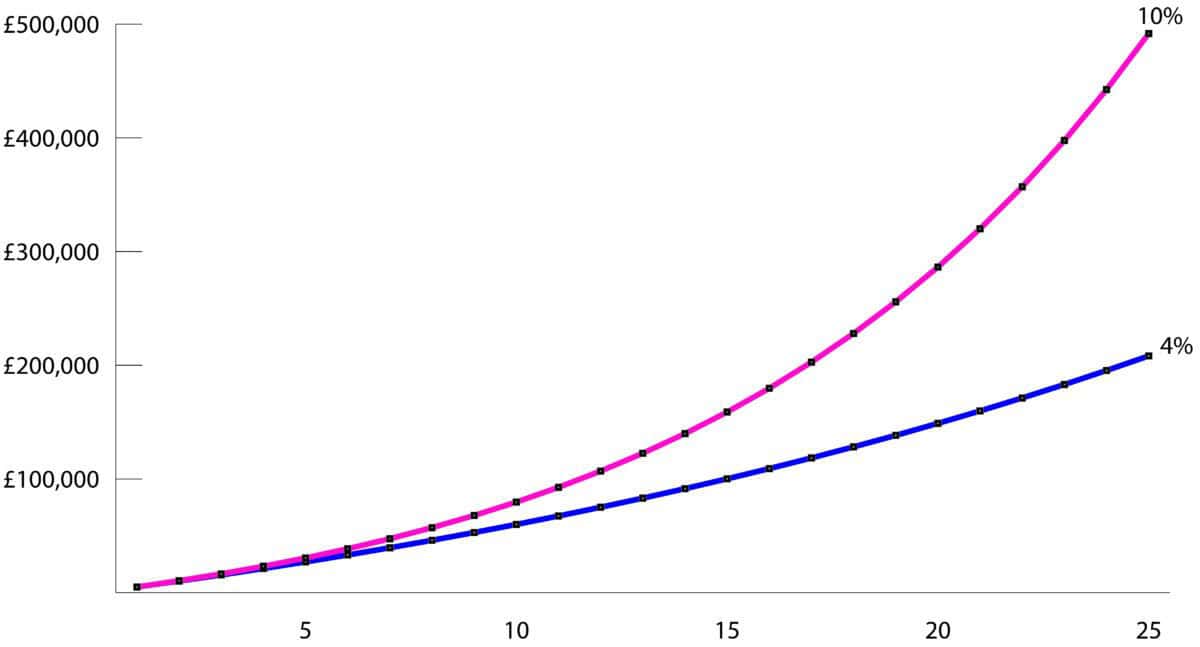

The next chart plots a yearly ISA contribution of £5,000 for 25 years attracting completely different annual returns. A ten% return would get comfortably to the goal. However a 4% return would take 39 years – manner past the parameters of the graph.

Chart generated by creator

Inventory choosing

Reaching a ten% return for 25 years is undoubtedly no imply feat. However for somebody keen to spend money on particular person shares, it’s a practical goal.

For the reason that flip of the millennium, many FTSE 100 shares have been multi-baggers. These embrace Unilever, Related British Meals, Diageo, Bunzl, and Rolls-Royce. As Warren Buffett as soon as stated: “let your winners run”. They are going to nearly definitely comfortably outrun your duds.

Exterior of luck, one is just ever prone to establish a handful of such shares throughout an investing lifetime. That is the place dividend shares can actually assist supercharge a portfolio.

Dividend performs

Not all high-yielding shares are created equal. I primarily search for a stable monitor report of elevating dividends. Take pension and life insurer Phoenix (LSE: PHNX). Over the previous 10 years, the dividend has been raised by 32%. Right now, it yields a whopping 8.4%.

Each the sustainability of its dividend and future will increase are tied to 3 monetary metrics. Firstly, and most significantly, working capital era (OCG). At H1 2025, OCG stood at £705m. Of that quantity, £274m was paid out in dividends.

Secondly, solvency protection ratio. Presently at 175%, this signifies a robust stability sheet with loads of choices for capital funding. Lastly, distributable reserves of the corporate are extraordinarily wholesome at £5.5bn, up 20% on 2024.

After all, there are dangers right here. An ongoing problem for the enterprise is sustained outflows from its numerous funds, notably these regarding pension financial savings. In a extremely aggressive business, this might put strain on future margins.

However zooming out to absorb the larger image, there’s a lot to love in regards to the enterprise. On prime of ageing demographics, a shift to outlined contribution office pension schemes has resulted in people taking an growing curiosity in making certain they’re saving adequately for retirement. For these in search of passive revenue, it’s definitely a inventory to think about.