Picture supply: Getty Photos

Investing in high-yield FTSE 100 dividend shares can create a considerable passive revenue. Fortunately, years of underperformance imply that many UK blue-chip shares supply really mighty dividend yields.

Shopping for high-yielding shares will be dangerous nonetheless. A big dividend yield generally is a signal of a distressed firm whose share value has sunk. It could wrestle to satisfy brokers’ payout forecasts and pay respectable dividends additional down the road.

In consequence, share pickers ought to consider sturdy corporations that reliably develop earnings over time. We’re speaking about companies with market-leading positions in mature markets and powerful steadiness sheets, as an example.

With this in thoughts, listed below are two big-paying FTSE dividend shares to think about proper now.

Authorized & Basic Group

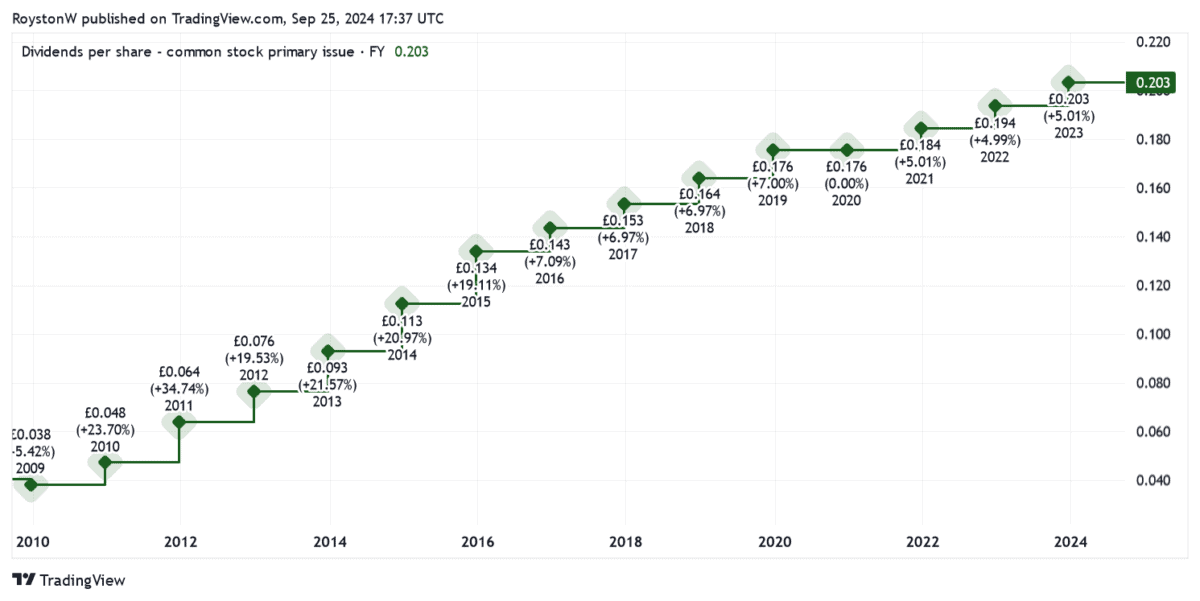

Put merely, Authorized & Basic‘s (LSE:LGEN) a money machine. It has a protracted file of delivering dividend will increase, which it maintained even through the Covid-19 disaster when many different UK blue-chips had been suspending, decreasing, or axing shareholder rewards.

The corporate’s pledged to maintain elevating annual dividends over the following few years too, albeit by a slower fee of three%. And I’ve no cause to doubt its means to satisfy this goal.

Its monetary foundations are rock strong, and its Solvency II capital ratio was 223% as of June. Final month, it offered its Cala housebuilding unit for £1.35bn too, to present its steadiness sheet further clout.

Metropolis analysts expect dividends to maintain rising by the following few years. And so L&G’s dividend yield stands at a whopping 9.4% for 2024, finally rising to 10% by 2026.

The ultra-competitive nature of its trade poses a risk to future shareholder returns. However I’m assured Authorized & Basic will proceed to thrive as a rising aged inhabitants drives demand for its retirement and wealth merchandise.

M&G Group

At 9.6%, M&G‘s (LSE:MNG) ahead dividend yield’s one of many greatest on the FTSE 100 in the present day. Examine that to the index’s broader ahead common which sits means again at 3.5%.

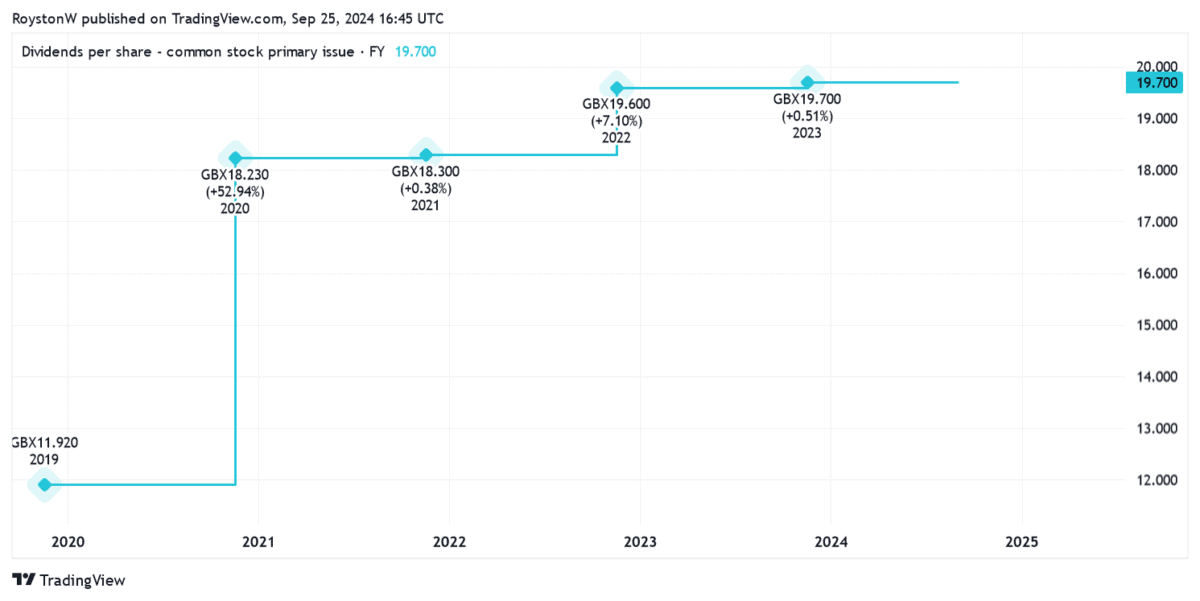

The monetary providers supplier doesn’t have the lengthy file of dividend progress of Authorized & Basic. However that’s as a result of it was solely spun out of Prudential again in 2019.

Nonetheless, because the chart above exhibits, shareholder payouts have risen strongly over the interval. And Metropolis brokers suppose the shareholder payout to maintain rising by the following few years too, leading to that mammoth yield for 2024, and which finally rises to 10.2% by 2026.

Like Authorized & Basic, M&G’s formidable money era has fashioned the bedrock of its expansive dividend coverage. And going by newest financials, it appears in nice form to proceed handsomely rewarding shareholders.

On the finish of June, its Solvency II ratio was 200%, up from 203% from the identical level in 2023.

As with the broader sector, income at M&G are delicate to volatility in monetary markets, rates of interest, currencies and inflation, to call only a few. This in flip may influence its share value.

Nevertheless, over the long run, I’m optimistic the FTSE agency will ship wonderful returns, pushed by those self same demographic drivers benefitting Authorized & Basic.