Retirement stays a far-off — and in some instances, unattainable — objective for a lot of People.

About one in 4 adults over age 50 stated they count on to by no means retire, in accordance with an AARP survey. That is maybe not stunning on condition that People imagine they will want $1.26 million to retire comfortably, per Northwestern Mutual.

Associated: Are You on Monitor for Your Age? This is When You Ought to Save for Retirement, Make 6 Figures and Purchase a House, In accordance with a New Survey.

In a brand new report from Financial institution of America, 68% of workers stated that saving for retirement is their No. 1 monetary objective, although working towards it typically comes with vital challenges.

The analysis, which surveyed practically 1,000 full-time workers who take part in 401(okay) plans and 800 employers who provide a 401(okay) plan, revealed that the typical worker does not begin saving for retirement till age 30 and desires that they had extra retirement training (33%).

Staff’ prime anticipated sources of retirement revenue have been as follows, per the survey: 401(okay) or 403(b) (85%), Social Safety (75%), checking or financial savings account 53%), IRA (38%), taxable brokerage or funding account (24%).

Associated: How A lot Cash Do You Must Retire Comfortably in Your State? This is the Breakdown.

Child Boomers are retiring at a fast fee, setting a file variety of retirees in 2024 that allowed Gen X to outnumber them within the workforce for the primary time, GOBankingRates reported.

On common, Boomers started saving for retirement at age 34; now of their 60s and 70s, one in 4 of them do not feel on observe to retire, in accordance with the Financial institution of America survey. Moreover, solely two in 10 Boomers stated they fully perceive their Social Safety advantages.

Rising healthcare prices in retirement current one other hurdle, as solely 34% of workers stated they’re saving and investing for future healthcare bills, regardless of present analysis exhibiting {that a} 65-year-old couple may wish as a lot as $428,000 in financial savings to cowl their retirement healthcare bills.

Associated: The best way to Begin Considering About Retirement Earlier than You Plan to Retire

Respondents stated the principle purpose they do not save for well being care is that they can not afford it, however many who’ve entry to an HSA by their employer additionally do not perceive the tax benefits and rollover course of.

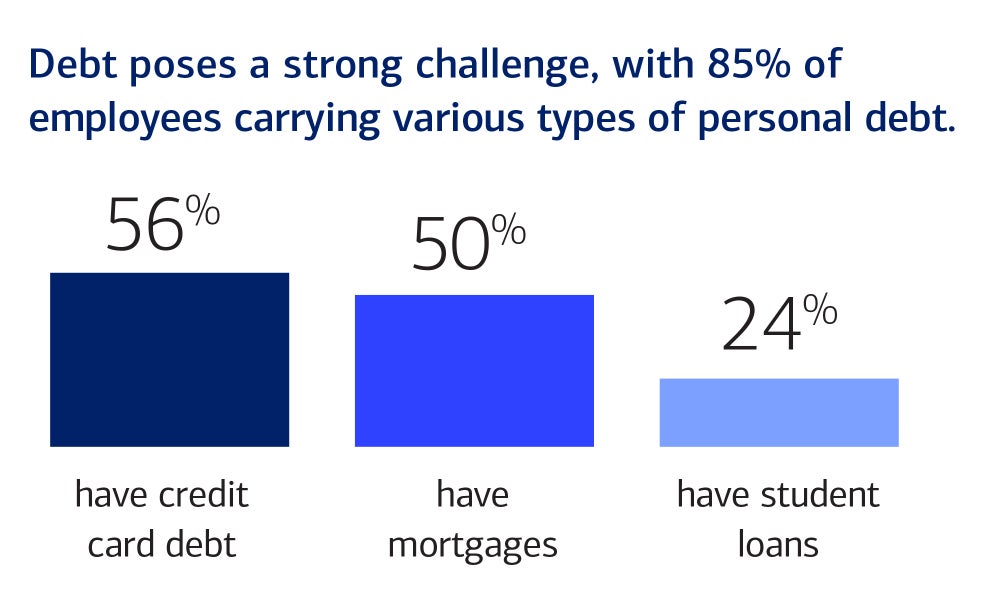

When workers throughout generations have been requested to replicate on what they might have completed otherwise to arrange for retirement, they cited three widespread errors: not beginning to save at a youthful age (49%), not taking full benefit of their employer’s 401(okay) match (35%) and never paying off debt sooner (36%).

Picture Credit score: Courtesy of Financial institution of America

“The fashionable worker needs assist with their broader monetary objectives,” Lorna Sabbia, head of office advantages at Financial institution of America, stated. “Employers ought to contemplate extra assets to assist their workforce in ways in which bolster their long-term objectives whereas additionally serving to them sort out short-term challenges.”