What’s the true value of manufacturing one Bitcoin? A recent report from Coinshares revealed some fascinating findings, underscoring the rising mining issue and the potential influence on miners.

Bitcoin halving occasions carry plenty of important and this 12 months’s having was notably notable. It’s because it was characterised by a surge in mining issue which can cut back the profitability. Consequently, many miners are compelled to close down their operations because of the lack of ability to breakeven.

Probably the most notable influence of the upper mining issue noticed lately is a surge in manufacturing prices. The Coinshares reviews estimated that the present value of manufacturing one Bitcoin was $49,500, which implies BTC mining is quickly changing into much less accessible to particular person miners.

CoinShares’ newest report exhibits that based mostly on second quarter money value knowledge, the common value of manufacturing one bitcoin for all listed miners is now $49,500, and if depreciation and inventory compensation are included, this common value will rise to $96,100. Mining firms are…

— Wu Blockchain (@WuBlockchain) November 3, 2024

– Commercial –

Bitcoin mining dangers changing into extra centralized as issue soars. It’s because institutional members within the BTC mining phase will finally be capable of sustain with the rising prices.

Bitcoin Miner Reserves Drop as Uncertainty Soars

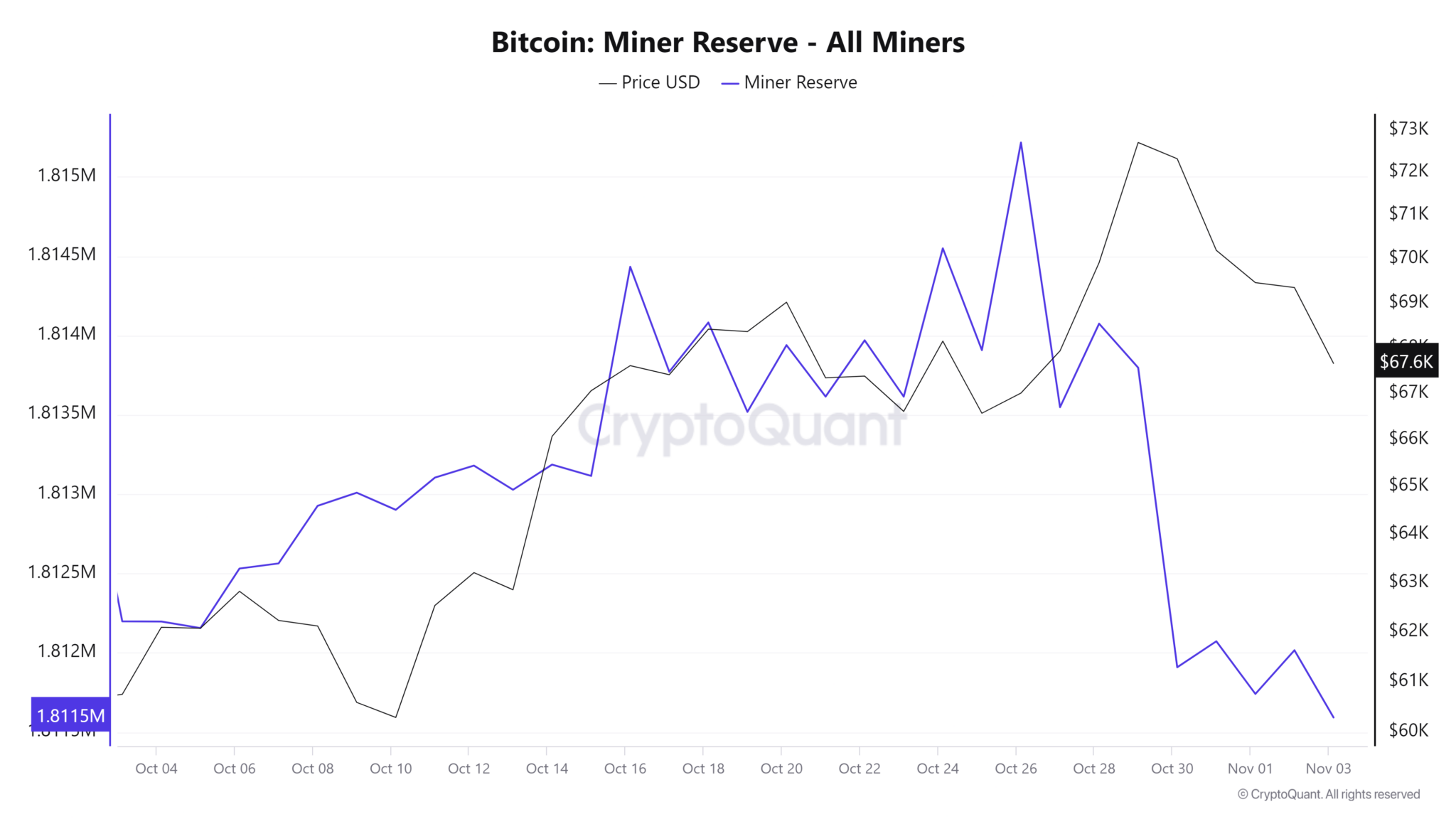

Bitcoin miner reserves preserve an fascinating relationship with the value of Bitcoin and the prevailing market sentiment. Miner reserves are inclined to develop when miners anticipate increased costs and dip throughout occasions of uncertainty.

October was an total bullish month for BTC and sentiments had been in favor of extra upside within the coming months. This led to a surge in Bitcoin miner reserves to a 4-week peak of 1.815 million BTC on 26 October. have been declining 26 October and have since dropped to 1.811 million BTC.

Bitcoin miner reserves | Supply: CryptoQuant

The distinction was equal to 40,000 BTC which equated to roughly $2.6 million at current market worth on the time of writing. In different phrases, miner reserve inflows and outflows contribute considerably to BTC’s value motion.

The decline in miner reserves was largely due to a surge in uncertainty concerning the U.S elections. An increase in miner reserves signifies that miners choose to carry in anticipation of upper costs.

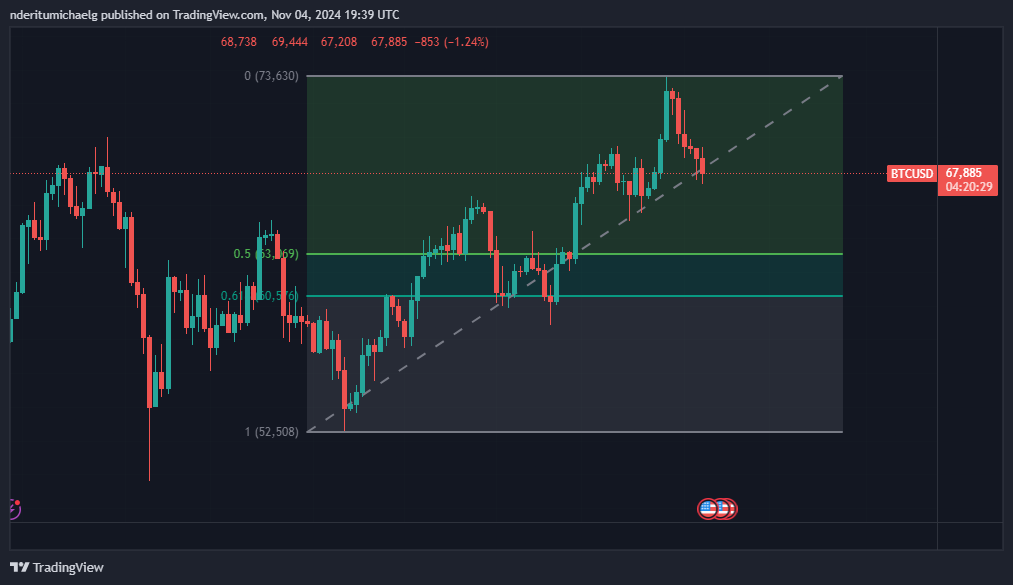

Will BTC Revisit the $60,000 Vary?

Just some days in the past it seemed like Bitcoin was headed in the direction of value discovery. Nonetheless, the return of uncertainty has had a destructive influence on value. BTC had already tanked as little as $67,208 within the final 24 hours on the time of writing.

The cryptocurrency was within the purple for the final 6 consecutive days, demonstrating a excessive stage of promote strain. Sustained uncertainty in the course of the week could result in extra draw back. Fibonacci retracement means that value could discover the underside of the present pattern between $60,500 and $63,100.

Bitcoin value motion | Supply: TradingView

Word that this was based mostly on the bottom value in September which was the beginning of its newest uptrend, and the current peak on the finish of October. Bitcoin had a $67,829 value on the time of writing which was solely a 6.92% dip away from the Fibonacci accumulation vary.