Key takeaways

- It’s best to by no means pay for airline miles except you’ve got a plan to make use of them immediately.

- Think about shopping for miles when you get a greater deal than paying for a flight in money, or when you’re brief a number of thousand miles for an award you need.

- Keep in mind that you do not have to pay for airline miles

- you’ll be able to earn them by spending on an airline bank card or journey bank card as an alternative.

There are all types of methods you should utilize to earn airline factors/miles, and that’s true whether or not you’re a frequent flyer or not. You may earn airline rewards through the use of an airline bank card or a versatile journey bank card for your whole spending, by procuring via airline rewards portals or by becoming a member of an airline’s eating membership.

It’s also possible to purchase airline factors or miles outright if you wish to rack up a stash shortly otherwise you simply have to prime off your account. However simply since you can purchase airline rewards, doesn’t imply it is best to. There are just a few conditions the place shopping for airline rewards makes any sense in any respect, which means you’ll be higher off incomes rewards in different methods the overwhelming majority of the time.

When you can purchase airline factors or miles

So, when does it make sense to buy airline factors or miles? Right here’s a rundown of the primary conditions the place you would possibly need to take into account it, in addition to the steps it is best to take to seek out out if it is smart in your scenario.

1. When you should utilize miles for a flight with a excessive money value immediately

First off, you might need to take into account shopping for miles when you’re planning to e-book an expensive fare with money and the price of bought miles works out to lower than you’ll pay. This situation normally makes probably the most sense if you’re about to purchase an costly worldwide fare in a premium cabin. Nevertheless, you’ll want to ensure to purchase the miles and lock within the award earlier than it disappears, as they typically do since award availability can change by the day (and even by the hour).

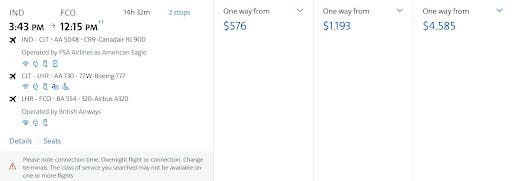

For instance, you’ll be able to usually purchase American AAdvantage miles for a price of three.76 cents per mile. Whereas that positively looks like rather a lot, it might repay when it’s worthwhile to e-book an expensive flight. As an example, perhaps it’s worthwhile to fly from Indianapolis, Indiana to Rome, Italy this fall and also you desperately need to fly in Enterprise class with a lie-flat seat. In that case, it might be potential to seek out enterprise class fares for as little as 57,500 miles plus $23 in airline taxes and costs.

EXPAND

Within the meantime, the money value for this one-way flight works out to $4,585.

EXPAND

So, how have you learnt this can be a whole lot? On this situation, you’ll subtract the $23 in airline taxes and costs from the money value to get $4,562. At that time, you’ll divide the remaining money quantity by 57,500 miles to get a per-mile value.

Once you do, you’ll discover that this per-mile value works out to 7.9 cents every ($4,562 / 57,500 miles = 0.079). Since you would purchase miles for lower than 4 cents every, you’ll get a greater worth with this technique than you’ll when you paid for the flight with money as an alternative.

2. Once you’re brief a number of thousand miles for an award you need

One other situation the place it’d make sense to purchase miles is if you’re just a few thousand miles brief for a reward redemption you need to make. On this scenario, you’ll be able to nonetheless get an excellent deal on bought miles whether or not they’re costly or not. In spite of everything, not shopping for miles might imply lacking out on the award flight you need altogether.

Fortuitously, most frequent flyer applications that allow you to purchase miles provide them in pretty small increments so you’ll be able to simply prime off your account. For instance, American AAdvantage, Air France / KLM Flying Blue and Delta SkyMiles all allow you to purchase as little as 2,000 miles at a time.

3. The airline is providing a bonus for bought miles

Every so often, many frequent flyer applications provide a “bonus” for buying miles, which usually interprets to a reduction off its common charges. Shopping for throughout considered one of these promotional durations is clearly higher than shopping for when a bonus isn’t supplied, however that doesn’t imply you can purchase miles only for the enjoyable of it.

Until you’ve got a selected redemption you need to make, it is best to actually solely purchase miles when you’ve got a purpose for them. In every other situation, it is best to solely purchase miles in the event that they’re supplied at a value that’s lower than what they’re usually price.

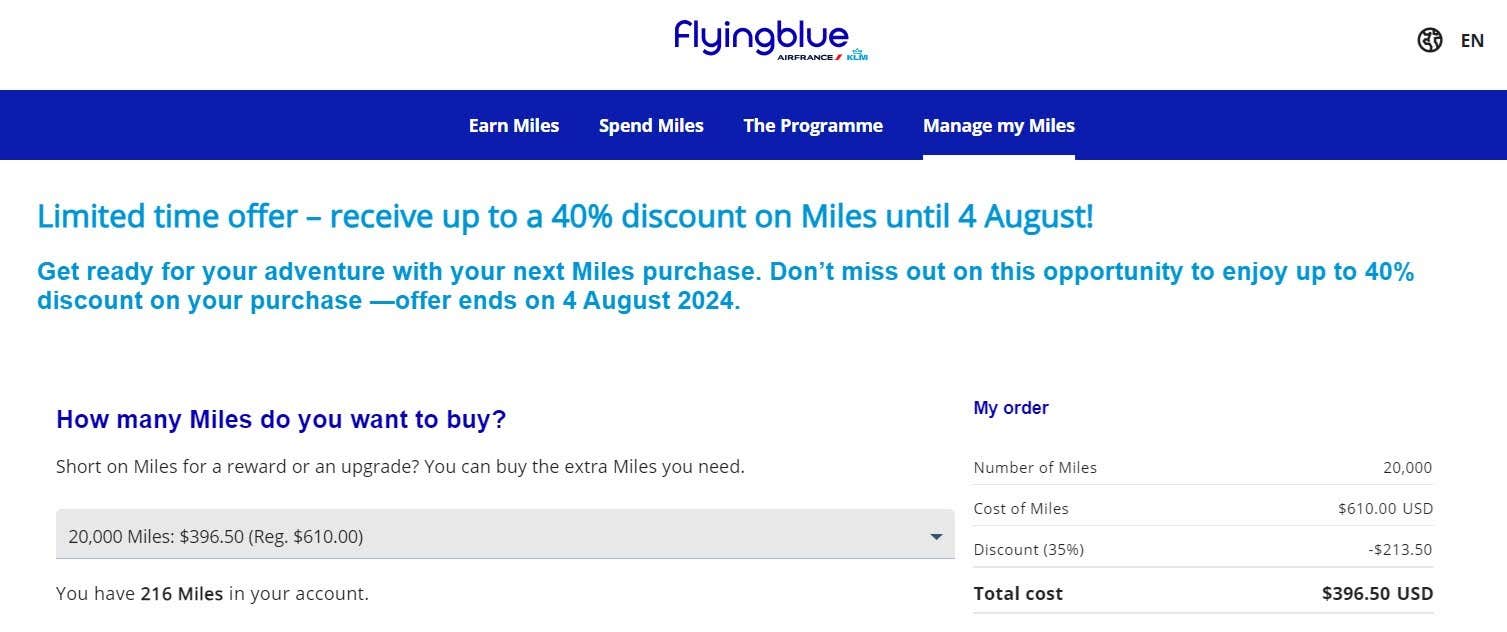

In the mean time, the Air France (Flying Blue) program is providing as much as a 40 % low cost on bought miles (on the time of writing this text). Which means 20,000 miles that will usually set you again $610 are presently on sale for $396.50.

EXPAND

If it’s worthwhile to make an Air France reserving anyway and also you’re brief on miles, the actual fact a reduction is being supplied makes this feature a reasonably whole lot.

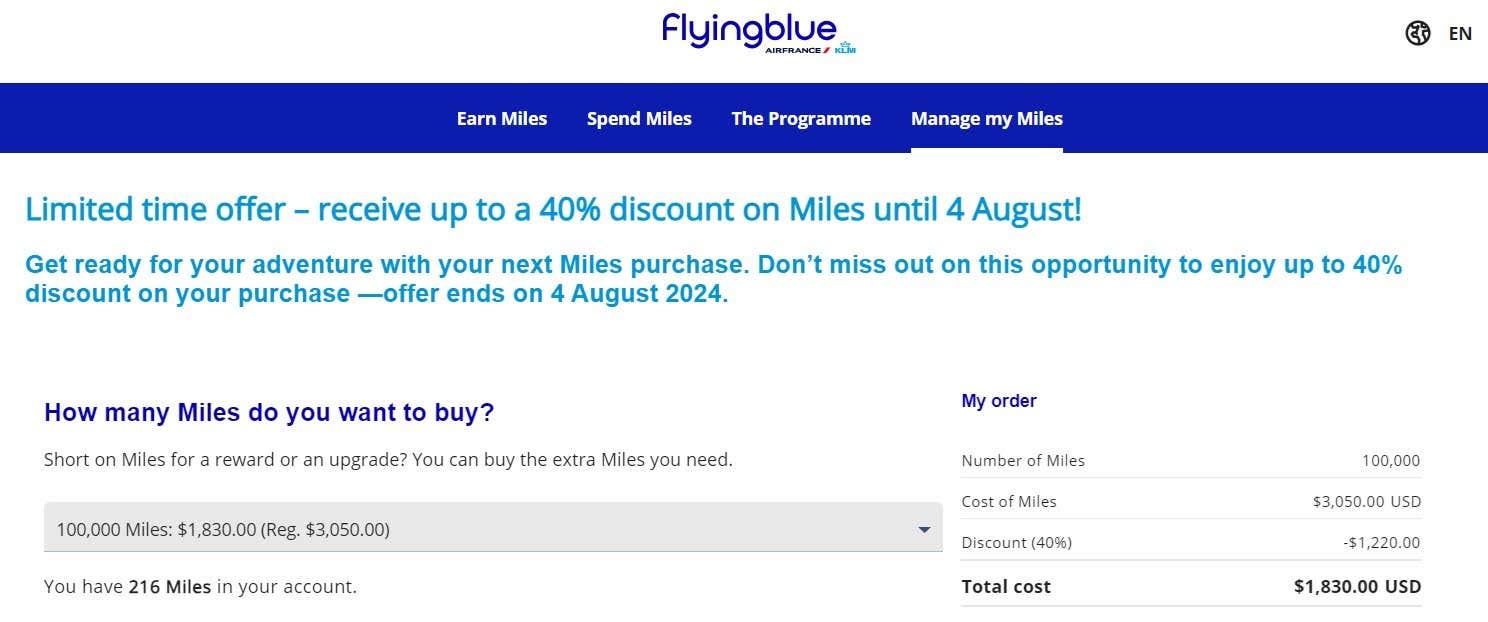

Then once more, the worth simply isn’t there to make the acquisition except you’ve got a concrete cause. For instance, our inside factors and miles valuations present that Flying Blue miles are usually price 1.5 cents every on common, but this system is asking members to pay $1,830 for 100,000 miles. This interprets to greater than 1.8 cents per mile, which is greater than any such level is price.

EXPAND

4. When it’s worthwhile to “reset the clock” so your award miles don’t expire

Shopping for miles can be a technique you should utilize to “reset the clock” when your airline rewards are about to run out. This transfer can work properly if you solely have a number of days or even weeks to indicate some exercise in your account earlier than the expiration date, so it’s worthwhile to make one thing occur shortly.

Nevertheless, since there are a number of free methods to earn extra miles — together with via co-branded bank card spending, airline procuring portals and frequent flyer eating golf equipment — it is best to solely use this feature as a final resort.

Once you shouldn’t purchase airline factors or miles

For probably the most half, there are two major eventualities when you shouldn’t buy airline factors or miles:

- You don’t want them proper now

- The factors/miles price greater than they’re truly price

In both case, you’re higher off focusing your power on all of the free methods you’ll be able to rack up airline factors and miles. For instance, you’ll be able to look into incomes a bank card sign-up bonus from among the finest airline bank cards, or you would discover a few of the greatest versatile bank card rewards applications that allow you to switch rewards to your favourite airways and lodges. It’s also possible to look into airline procuring portals and eating golf equipment, which make it potential to earn factors/miles for on-line procuring and eating out.

Which bank card must you use to purchase airline factors or miles?

The most effective bank card for purchasing airline factors or miles will depend upon the tactic you should utilize to buy them.

Some frequent flyer applications don’t promote factors/miles straight, however you should buy them via a third-party web site referred to as Factors.com, which options over 60 airline, journey and monetary companions. On this situation, the factors/miles you bought with a bank card wouldn’t code as a journey buy, so that you wouldn’t have the chance to maximise your buy with bonus factors/miles on journey.

That mentioned, a number of frequent flyer applications allow you to buy factors/miles straight on their web sites. A few of these applications embody Air France / KLM Flying Blue, American AAdvantage, Avianca LifeMiles, British Airways Govt Membership, Delta SkyMiles, Southwest Fast Rewards, United MileagePlus and extra.

In these eventualities, you would go for a versatile journey bank card that permits you to earn bonus rewards on all purchases made straight with airways. Some strong versatile journey bank cards to contemplate are the Chase Sapphire Most popular® Card, Chase Sapphire Reserve® and American Categorical® Gold Card, to call a number of.

Nevertheless, if you’d like frequent flyer perks like free checked baggage or precedence boarding, you would go for an airline bank card that gives bonus rewards on airline purchases. Simply be sure you tailor your card choice to this system you employ probably the most and need to purchase factors/miles with.

For those who’re extra within the American AAdvantage program, for instance, take into account signing up for the Citi® / AAdvantage® Platinum Choose® World Elite Mastercard®* or the Citi® / AAdvantage® Govt World Elite Mastercard®. For those who’re a Delta flyer, alternatively, you might need to look into playing cards just like the Delta SkyMiles® Gold American Categorical Card or the Delta SkyMiles® Platinum American Categorical Card.

The underside line

At this level, you’ll have a number of lingering questions. For instance, is shopping for airline miles an excellent deal? Or, is it price it to purchase airline miles in any respect? Sadly, the reply to each of these questions is normally no. Shopping for airline miles solely is smart in a number of conditions, and also you’ll most likely nonetheless have to do some simple arithmetic earlier than you determine. Once you do run the numbers, you’ll nearly at all times discover the mathematics isn’t in favor of shopping for factors or miles.

Lastly, bear in mind all of the methods you’ll be able to earn airline rewards with out paying for them, together with signing up for a co-branded airline bank card (the place you’ll be able to earn a sign-up bonus and ongoing rewards on bonus class spending). With some analysis and planning, you may get all of the miles you want (plus some) with out paying for the privilege.

*The details about the Citi® / AAdvantage® Platinum Choose® World Elite Mastercard® has been collected independently by Bankrate.com. The cardboard particulars haven’t been reviewed or accredited by the cardboard issuer.