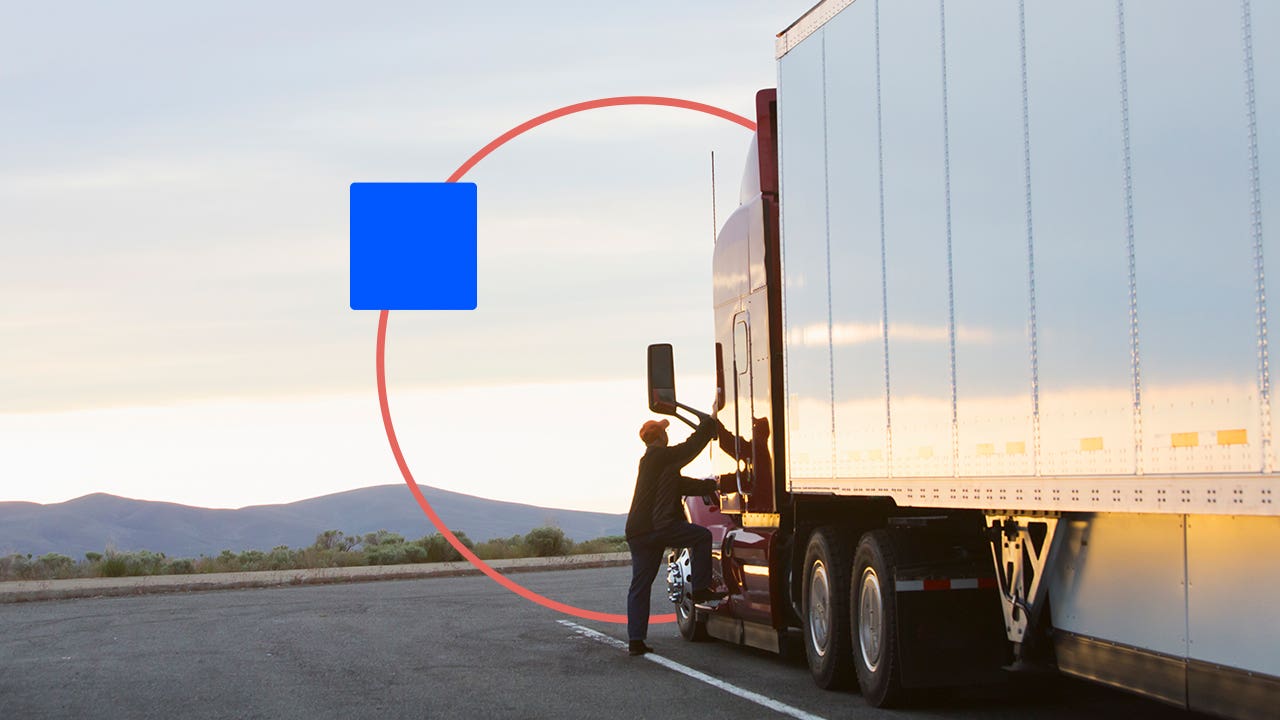

Jetta Productions Inc/GettyImages; Illustration by Hunter Newton/Bankrate

Key takeaways

- Semi-truck financing might help you purchase a truck with out impacting your small business’s money circulation

- Direct lenders usually have extra business data than banks or on-line lenders

- Getting a semi-truck mortgage from a web-based lender is normally the quickest technique to get funded

Semi-truck financing is usually a good various to paying money for a semi, which frequently hurts your small business’s funds. Banks, on-line lenders and direct lenders have mortgage merchandise that may cowl the price of shopping for a brand new or used truck and trailer. Every sort of lender has benefits and drawbacks, so it’s smart to check eligibility necessities and prices earlier than you submit an utility.

Let’s check out the place you will get semi-truck loans and among the high lenders for semi-truck financing.

Banks

Most banks provide gear loans that you should use to buy a semi-truck or every other piece of enterprise gear. Banks usually have the bottom rates of interest and waive prepayment penalties. However they will not be as conversant in your business as direct lenders and normally have excessive minimal credit score rating necessities for approval.

Examine banks that provide semi-truck loans

Banks provide big-rig financing within the type of gear loans. These are designed to assist companies buy main belongings, together with semi vans and trailers. Most phrases are capped at 60 months (5 years), however some are shorter if you wish to restrict the curiosity you pay.

| Lender | Mortgage sort | High options |

|---|---|---|

| Financial institution of America | Tools mortgage |

|

| TAB Financial institution | Tools mortgage |

|

On-line lenders

On-line lenders, typically referred to as various lenders, function just about. They usually fund a lot sooner than a conventional financial institution, in as little as 24 hours. However, they’re unlikely to have a bodily department the place you possibly can go in and meet face-to-face to handle your mortgage. On-line lenders may additionally cost greater rates of interest than brick-and-mortar banks.

Examine on-line lenders that provide semi-truck loans

When evaluating on-line lenders, pay particular consideration to customer support channels. Since the whole lot is completed on-line or over the cellphone, you wish to be sure you have entry to assist if you’re more than likely to wish it. It’s additionally a good suggestion to check at the least three lenders to make sure you get probably the most reasonably priced mortgage.

| Lender | Mortgage sort | High options |

|---|---|---|

| Credibly | Tools mortgage |

|

| Nationwide Funding | Tools mortgage |

|

| Triton Capital | Tools mortgage |

|

Direct lenders

Direct lenders are operations that lend their very own cash. They don’t are likely to have a prolonged underwriting course of as a financial institution does, providing fast turnaround on approvals and funding. And direct lenders usually have specialised data in truck lending. However, some direct lenders cost greater charges and costs in comparison with conventional lenders.

Examine direct lenders

When evaluating direct lenders, think about the credit score necessities. Some work with anybody, whereas others have a minimal rating within the excessive 600s.

| Lender | Mortgage sort | High options |

|---|---|---|

| CAG Truck Capital | Semi-truck mortgage |

|

| Balboa Capital | Semi-truck mortgage |

|

| Truck Lenders USA | Semi-truck mortgage |

|

| Industrial Fleet Financing | Industrial gear mortgage |

|

Backside line

The very best semi-truck loans can flip costly gear into an reasonably priced answer for your small business wants. Banks have a streamlined course of with aggressive charges, however you may additionally discover a good provide from a web-based or direct lender in case you don’t want quite a lot of in-person consideration. Examine the professionals and cons of every lender earlier than you pull the set off.