Picture supply: Getty Pictures

It’s no secret that Nvidia (NASDAQ: NVDA) inventory has been among the finest market performers of all time.

Up round 72,300% in 20 years, it has made affected person, long-term shareholders an absolute fortune. And founder Jensen Huang one of many world’s richest folks!

Naturally, will probably be a tall order for different shares to repeat such eye-popping returns over the following 20 years. However at any cut-off date, there are shares hiding in plain sight that go on to change into 10-baggers, and even 100-baggers.

In different phrases, the inventory grows 10 or 100 occasions in worth!

The place would possibly these potential fortune-makers be? Let’s flip to an funding fund that backed Nvidia a few years in the past to see what its managers assume.

Trying to find outliers

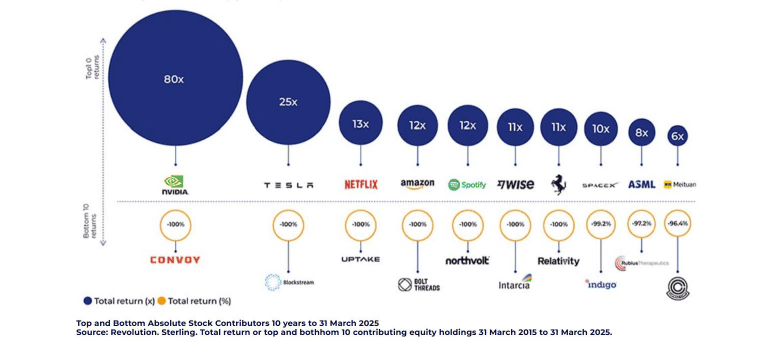

Scottish Mortgage Funding Belief (LSE: SMT) is a FTSE 100 agency that spends a lot of its time trying to find the following Nvidia. It first invested within the AI chipmaker again in 2016, and has since revamped 80 occasions its cash on that place.

Finest and worst returns for Scottish Mortgage up to now 10 years:

Be aware, these calculations solely go as much as 31 March. Since then, Nvidia’s share value has jumped 47%, which means the return would now be over 100 occasions.

Nevertheless, Scottish Mortgage has been decreasing its Nvidia place this 12 months. Supervisor Tom Slater explains: “A world constructed on $70,000 chips and 60% margins isn’t more likely to endure. So we diminished our place, not as a result of we admire the corporate any much less, however as a result of we’re disciplined. We search for uneven outcomes, and at a $3.5trn valuation it’s a lot tougher to make distinctive returns.”

This factors to a threat that Nvidia’s pricing energy — and due to this fact margins — would possibly come beneath strain within the years forward. Whereas these are legitimate issues, it’s additionally price noting that Scottish Mortgage hasn’t bought its whole Nvidia holding.

The corporate’s merchandise are additionally relevant to huge adjoining development markets, notably self-driving vehicles and humanoid robots. However the discount suggests the managers see decrease returns forward as a result of Nvidia’s juggernaut stature.

The following era of winners?

So, what else is Scottish Mortgage backing at present? Effectively, some holdings, together with SpaceX and Stripe, are nonetheless unlisted. So traders can’t purchase shares of these but.

Not too long ago, it’s been loading up on Meta Platforms and Taiwan Semiconductor Manufacturing (TSMC). However with their already monumental market caps, these aren’t precisely what I’d name hidden gems.

Within the desk under then are 10 development shares which are within the prime 30 holdings, every with market caps under $100bn. In different phrases, they’re not already tech mega-caps, and Scottish Mortgage seems to have robust conviction of their development prospects.

| Firm | What It Does | Market Cap |

|---|---|---|

| Sea Restricted | Southeast Asian e‑commerce, fintech and gaming | $88bn |

| Snowflake | Cloud‑primarily based information warehousing and analytics | $74bn |

| Roblox | On-line gaming platform | $70bn |

| Cloudflare | Internet efficiency and safety companies | $66bn |

| Coupang | South Korean e‑commerce platform | $55bn |

| Insulet | Maker of the Omnipod insulin supply system | $21bn |

| Clever | Cross-border cash transfers | £11bn |

| Tempus AI | AI-driven most cancers diagnostics and precision medication | $10bn |

| Aurora Innovation | Autonomous automobile expertise | $9bn |

| Oddity Tech | Tech-powered magnificence platform | $4.bn |

Silly takeaway

In fact, there’s no assure that these will show to be the following large winners. Most are investing closely for development and due to this fact not optimised for income. Some might stay loss-making endlessly.

In the meantime, the Scottish Mortgage group would possibly fail to establish the following era of outliers, which might harm investor confidence in its technique.

Nevertheless, I really feel these shares can be utilized as a springboard for additional analysis. If any succeed wildly, they’ve the potential to make affected person development traders some huge cash.

Alternatively, extra risk-averse traders may take into account Scottish Mortgage shares.