With on-line invoice cost and cell wallets on the rise, shoppers are relying much less on paper checks. Those that do nonetheless write checks are seemingly shocked by the value when it’s time to reorder.

You will discover the perfect deal when ordering checks by evaluating what your financial institution will cost you with the value you’ll pay on-line at numerous third-party test printers. It’s possible you’ll discover these corporations cost significantly lower than your financial institution costs for checks (and would possibly supply cooler designs). When contemplating a third-party printer, nevertheless, it’s necessary to take some fundamental precautions.

Corporations that promote private checks

A fast survey of costs that non-banks cost for traditional blue checks finds that you just’ll seemingly pay between 4 and 25 cents for single checks. Likewise, you’ll pay between round 6 and 30 cents for duplicate checks. Duplicate checks are those who have a skinny piece of paper behind them that acts as a carbon copy.

Single checks

| Firm | Variety of checks in a single field | Price, 2 bins | Price per test |

|---|---|---|---|

| Sam’s Membership | 240 | $17.38 | $0.04 |

| Checks.com | 80 | $11.90 | $0.07 |

| Costco | 125 | $20.22 | $0.08 |

| Promise Checks | 100 | $15.90 | $0.08 |

| Vistaprint | 150 | $24.00 | $0.08 |

| Walmart | 240 | $19.62 | $0.08 |

| Checks within the Mail | 100 | $38.25 | $0.19 |

| Checks Limitless | 80 | $29.98 | $0.19 |

| Chase Financial institution (offered by Deluxe) | 80 | $40.00 | $0.25 |

Duplicate checks

| Firm | Variety of checks in field | Price, 2 bins | Price per test |

|---|---|---|---|

| Sam’s Membership | 165 | $18.85 | $0.06 |

| Checks.com | 80 | $13.90 | $0.09 |

| Walmart | 120 | $22.56 | $0.09 |

| Costco | 100 | $20.70 | $0.10 |

| Vistaprint | 150 | $30.00 | $0.10 |

| Promise Checks | 80 | $21.90 | $0.14 |

| Checks within the Mail | 100 | $44.65 | $0.22 |

| Checks Limitless | 80 | $39.98 | $0.25 |

| Chase Financial institution (offered by Deluxe) | 80 | $48.00 | $0.30 |

Costs retrieved on-line Feb. 28, 2024

The most cost effective supplier we might discover was Sam’s Membership. The Walmart-owned shopping for membership sells single checks for about 4 cents every, far lower than the value you’ll pay ordering them by Chase Financial institution’s check-reordering vendor.

After all, value isn’t every little thing; you don’t wish to give your checking account data to a sketchy, fly-by-night operation. Should you’ve by no means heard of the positioning you’re considering of ordering from, test on them by way of a Higher Enterprise Bureau (BBB) search earlier than you quit any delicate data.

Steps to get low cost private checks

- Verify in case your financial institution gives free checks. Some banks supply free commonplace checks to account holders, which may embrace the primary e-book of checks or subsequent refills. Monetary establishments that supply free commonplace checks to their prospects or members embrace Ally Financial institution and Navy Federal Credit score Union.

- Look on-line for offers and promo codes on checks. You could possibly get monetary savings by discovering offers for reductions or free transport when ordering checks on-line. Websites that usually checklist such gives embrace CouponCabin and RetailMeNot.

- Order your checks in bulk. This can be worthwhile if the value per test is decrease if you order a bigger amount. What’s extra, ordering fundamental, commonplace designs will seemingly be cheaper than ones with multicolored, customized pictures.

- Go along with economic system transport. If the vendor gives completely different transport speeds and also you don’t want expedited transport, choosing the longest transport time will seemingly prevent a great deal of cash.

The secure locations to buy

If going exterior your financial institution to get checks makes you nervous, needless to say banks usually don’t print checks. They ship them to a third-party printer, equivalent to Deluxe or Harland Clarke, so all you’re actually doing is reducing out a intermediary.

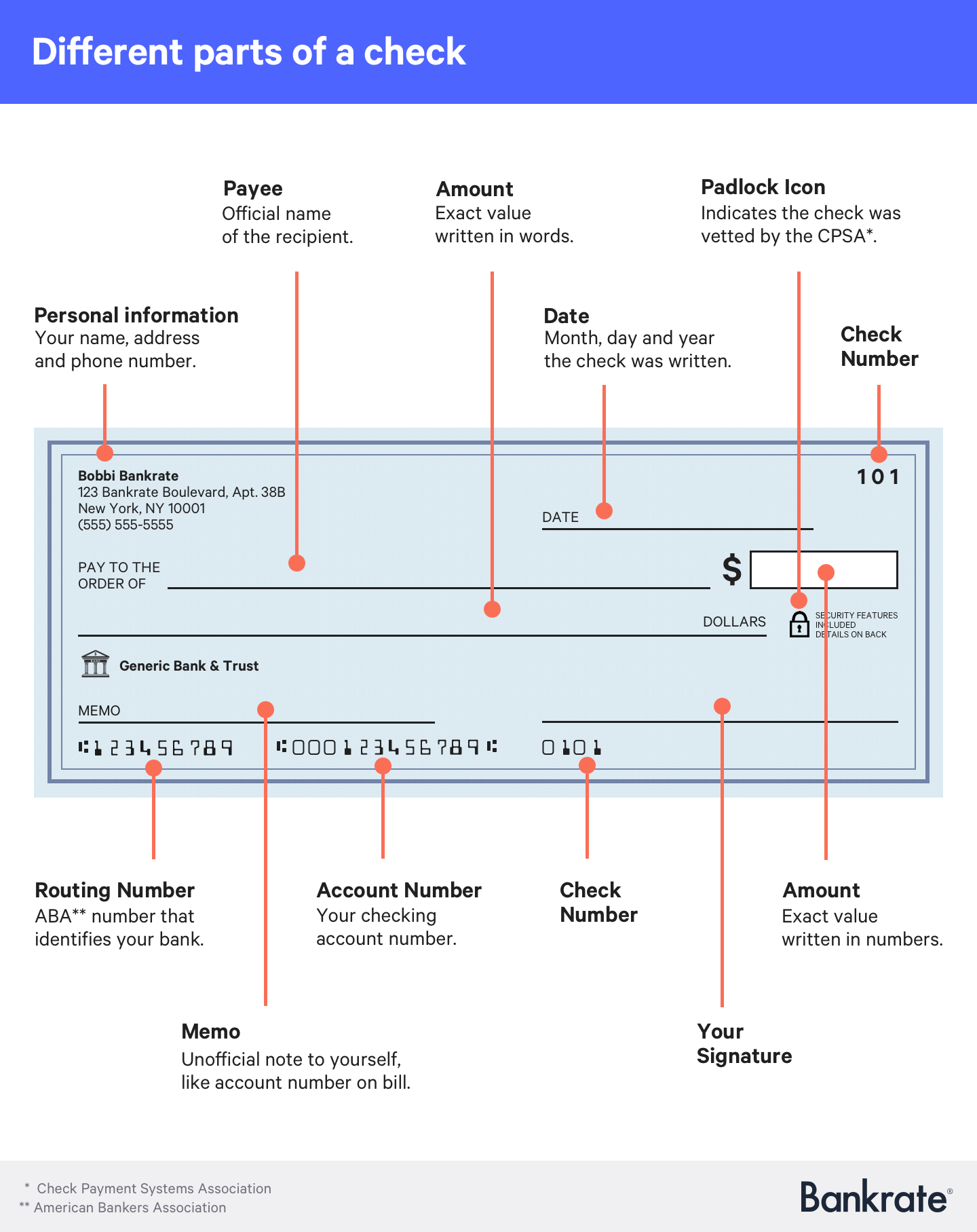

One straightforward approach to inform whether or not you’re ordering checks from a good firm whose merchandise meet fundamental safety requirements is to search for somewhat padlock icon on the best facet of their checks underneath the “quantity” field. If it’s there, you realize the test and the corporate itself have been vetted by the Verify Fee Programs Affiliation (CPSA).

“The padlock icon is a manner of letting people who find themselves dealing with checks know that the checks which are of their possession have a minimum of a minimal variety of security measures that may defend towards alteration of a test and duplication of a test,” says Steven Antolick, CPSA government director.

The web site of the Verify Funds System Affiliation (CPSA), a nonprofit commerce affiliation, gives an inventory of all of its approved printers. Checks within the Mail and Deluxe, that are retailers in Bankrate’s desk above, are listed on the CPSA web site as approved printers.

All the pieces it’s good to place a test order

Should you determine to make the leap, every little thing it’s good to order new checks on-line could be discovered on certainly one of your outdated checks (or a brief test, if it’s a brand new account). This data might embrace:

- Your checking account quantity

- Your financial institution’s routing quantity, which you can even discover on the financial institution’s web site

- The test quantity in your final test, so you realize which quantity your new checks ought to begin with

- In some states, the date you opened the account

You’ll additionally wish to double-check your order earlier than making it last. Whereas printers usually confirm your account particulars with the financial institution earlier than printing, checks with the incorrect account data on them aren’t very helpful.

Safety is crucial function

Should you’re going to spend greater than the naked minimal on a test, it ought to be on check-safety options, says Magnus Carlsson, a product supervisor with the Federal Reserve Financial institution of Boston.

“Checks are the cost technique with essentially the most fraud,” Carlsson says. “So something you are able to do to have extra safety is a giant factor.”

Safety features equivalent to extra hard-to-copy microprint, hologram foil, warmth sensors and hard-to-duplicate watermarks can enhance the price of checks.

The price of added test safety might be extra manageable for shoppers, who write checks sometimes, than it’s for companies that write 1000’s and even thousands and thousands of checks per yr. Examine your prices with the potential fallout from fraud, Carlsson says.

Backside line

Ordering checks could be expensive, and you might save deal by going with a web based printer as a substitute of your financial institution. It’s necessary to analysis any third-party vendor earlier than giving them your checking account data. Your finest guess could be a good firm that gives checks with necessary security measures.

– Claes Bell, CFA contributed to a earlier model of this text.