Picture supply: Getty Photographs

The Self-Invested Private Pension (SIPP) is a car for rising our retirement funds. Personally, all my pensions have been consolidated into this car and are self-managed.

Nonetheless, like many individuals my age — 32 — I’m already questioning whether or not my pension goes to be massive sufficient to help me in my later years. In fact, I’ve loads of time. Nonetheless, my prospects could possibly be higher if I had began earlier.

Within the UK, we will begin a pension at any age. And that’s why my daughter, now one, has a couple of thousand kilos in her pension already. Let’s take a better have a look at why we’re doing this.

Decreasing the burden on her

I’ve to be sincere, I’m not extremely assured concerning the world I’m bringing my baby into. On a really fundamental degree, international assets are stretched and competitors for these assets is changing into more and more intense. Coupled with the rise of synthetic intelligence (AI), like many mother and father earlier than me, I’m wondering what the long run holds.

With that in thoughts, it’s at all times good to have a nest egg, or slightly extra. By beginning a pension as we speak, there could also be much less onus on her to place more cash apart when she begins working. Individuals typically discuss how laborious it’s to place cash apart as we speak… what if it’s more difficult sooner or later?

Compounding

Compounding’s key. That is when the cash our investments make begins incomes its personal curiosity. It’s like a snowball getting larger and drawing in additional snow because it rolls. That’s how compounding works.

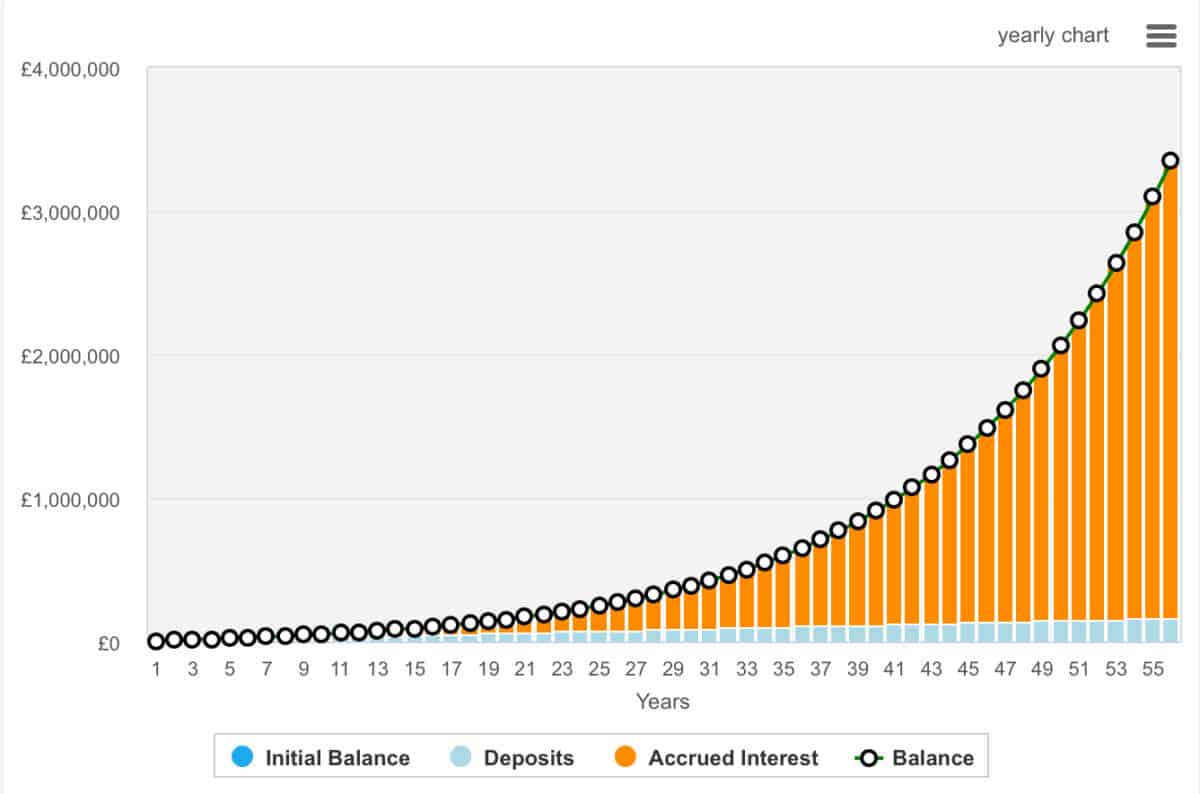

On this case, the present £3,000 in my daughter’s SIPP may develop to £425k by the point she’s my age. That’s assuming the upkeep of £240 of month-to-month contributions and an 8% annualised progress price.

In fact, that’s too younger to retire within the UK. However from 32 onwards, her SIPP shall be rising extraordinarily quick due to the aforementioned compounding. Simply have a look at this graph and the tempo of progress within the later years.

The place am I investing?

Because it’s a comparatively small portfolio, I’m preferring trusts, funds, and conglomerates. These present diversification with a singular funding.

One of many investments is Berkshire Hathaway (NYSE:BRK.B). The Warren Buffett inventory hasn’t carried out too badly contemplating the current volatility. It stays probably the most carefully watched firms in international markets, largely as a consequence of its diversified portfolio and Buffett’s long-term funding philosophy.

The corporate owns a mixture of wholly-owned companies — together with GEICO, BNSF Railway, and Berkshire Hathaway Vitality — alongside important fairness stakes in public firms equivalent to Apple, Coca-Cola, American Categorical, and Occidental Petroleum. As of 2025, Apple stays its largest holding, although current disclosures present elevated publicity to vitality and monetary companies.

The corporate’s large money hoarding has additionally raised eyebrows. Buffett has amassed greater than $330bn in money, and now owns round 5% of all US treasuries. This has contributed to its current resilience.

Nonetheless, it stays very US targeted. Within the close to time period, at the least, this represents one thing of a threat as President Trump’s commerce insurance policies seem to have rattled some enterprise house owners. Regardless of this, it’s one I’ll proceed to purchase for the long term.