Picture supply: Getty Photographs

Previous efficiency isn’t any assure of future returns. However new analysis from eToro means that now may very well be a good time for me to load up on FTSE 100 shares.

The Footsie‘s up 1% to this point in December in what some say may very well be the beginning of a Santa Rally. Markets are rising on hopes of imminent rate of interest cuts by the Federal Reserve, together with tax reductions beneath the returning President Trump.

Historical past exhibits that December rallies are not any uncommon incidence. In response to eToro, “inventory market buyers get pleasure from nearly 1 / 4 of their annual returns in December“. And UK buyers specifically acquire probably the most from end-of-year fizziness on monetary markets.

The FTSE outperforms

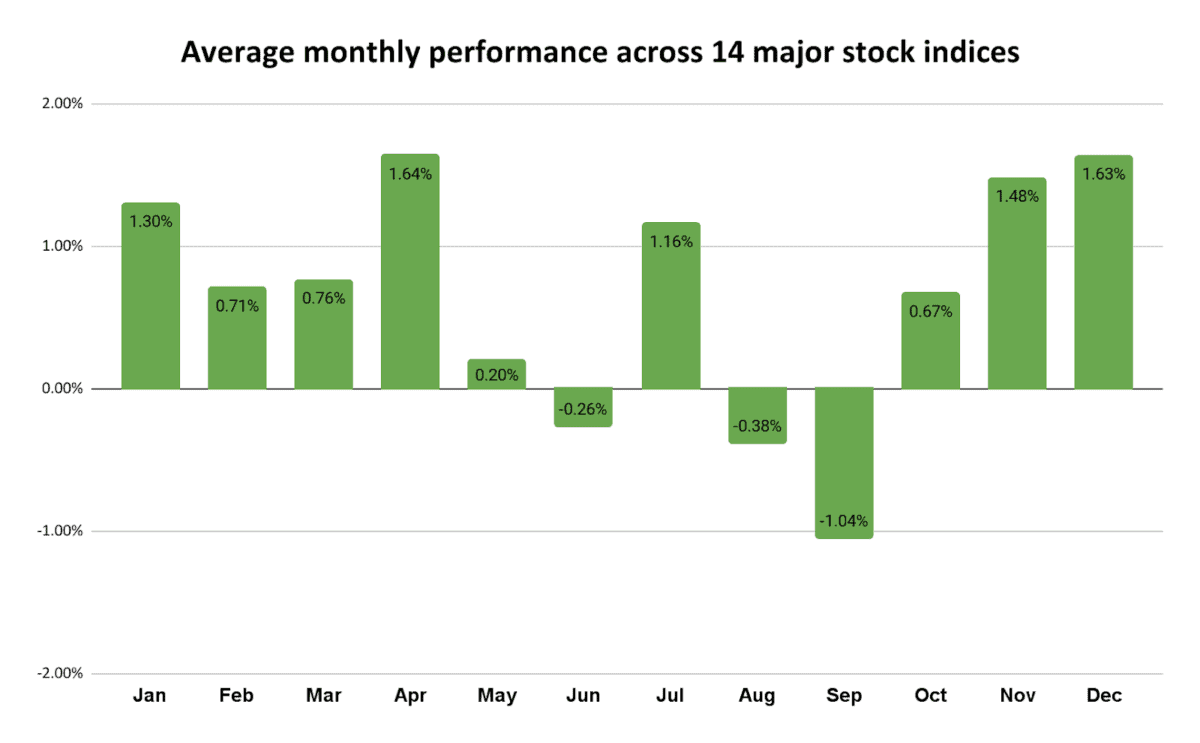

Dealer eToro seemed on the efficiency of 14 main international indexes throughout the previous 50 years. It confirmed that “returns in December common 1.63%, comfortably outpacing the 0.57% common month-to-month return from January to November“.

Encouragingly for UK buyers, the FTSE 100 has left nearly all different main indexes in its wake over previous festive intervals, too.

It has delivered a mean December return of two.29% since its formation in 1984, outperforming the opposite months of the yr by a meaty 1.93%. On common, a whopping 36% of the Footsie’s annual returns have been made within the final month of the yr.

December’s common return is healthier than the 1.28% that the S&P 500 has offered in current many years. Solely Hong Kong’s Dangle Seng index has offered a greater common last month return throughout main international indexes, at 3.09%.

A prime inventory I’m contemplating

As I stated on the prime, previous efficiency shouldn’t be a dependable information to the longer term. And proper now, fears over US commerce tariffs, China’s struggling financial system, and struggle in Europe and the Center East all pose a risk to this yr’s Santa Rally.

But regardless of macroeconomic and geopolitical dangers, I really feel that inventory investing is value critical consideration, whether or not that be in December or another month of the yr.

This displays the superior long-term returns buyers get pleasure from versus simply holding cash in money. Somebody who purchased a FTSE 100 tracker fund in 2019, as an illustration, would have loved a strong common yearly return of 6.2%.

Buying particular undervalued shares this December may present an even-better return. Phoenix Group (LSE:PHNX) is one dirt-cheap inventory I’m contemplating for my very own portfolio.

In 2025, annual earnings are anticipated to soar 22%. This leaves it buying and selling on a ahead price-to-earnings (P/E) ratio of 9.4 instances.

Moreover, the FTSE firm additionally has a price-to-earnings development (PEG) ratio of 0.4. Any sub-one studying signifies {that a} share is undervalued.

Lastly, the dividend yield on Phoenix shares is a market busting 10.8%.

Regardless of the specter of excessive competitors, income right here may soar as falling rates of interest increase client demand. Phoenix’s backside line also needs to rise as demographic adjustments drive pension gross sales, now and over the long run.

This can be a share I’m contemplating shopping for for my very own portfolio. I believe it may see critical share worth enchancment in December and past.