A current Cambridge report confirms that the US now leads world Bitcoin mining, prompting questions on how China will reply. Although the nation has lengthy held an anti-crypto stance, Chinese language mining swimming pools have traditionally managed a considerable portion of the worldwide Bitcoin hashrate.

The US’s present aggressive edge and renewed hostility over commerce coverage may encourage China to recapitulate. BeInCrypto spoke with representatives from The Coin Bureau and Wanchain to know what may encourage China to alter its stance towards digital property.

US Overtakes China as High Bitcoin Mining Hub

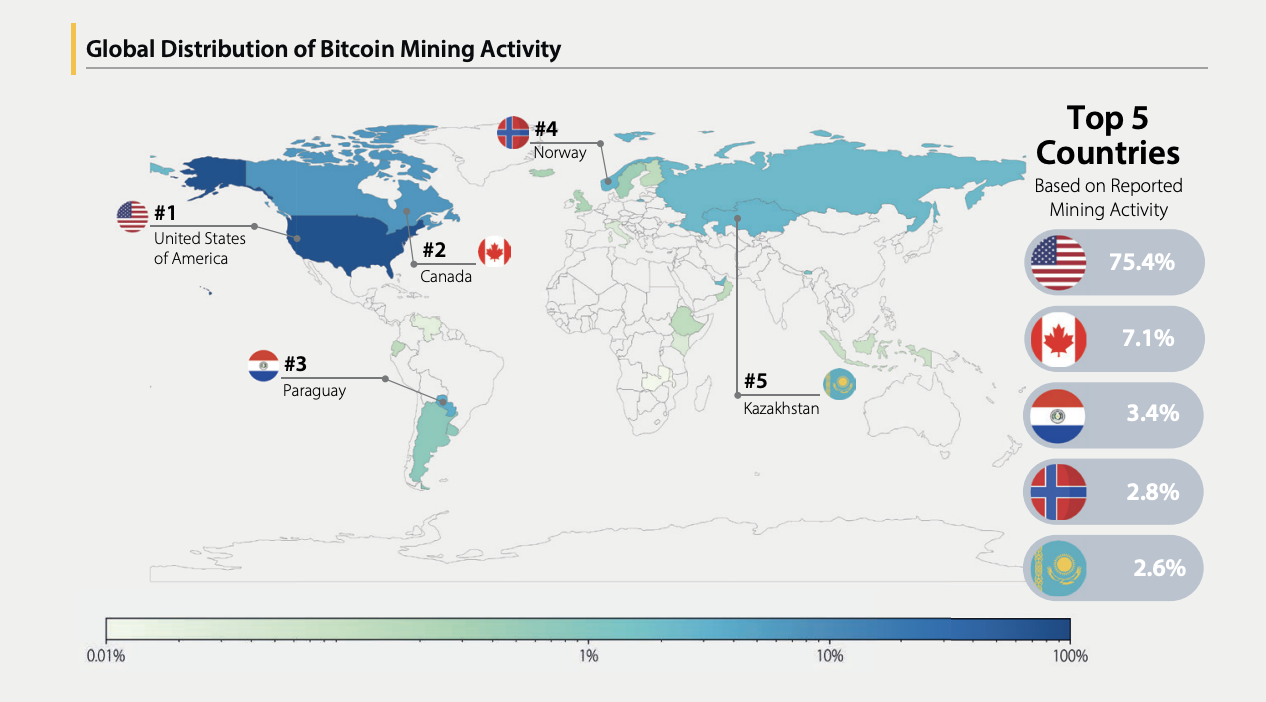

The US has firmly established itself because the world’s largest Bitcoin mining hub. A current Cambridge Centre for Different Finance (CCAF) report revealed that the US accounts for 75.4% of the reported hashrate.

World distribution of Bitcoin mining exercise. Supply: CCAF.

This latest improvement confirms a notable reversal of energy over Bitcoin mining dominance. China emerged because the world’s main Bitcoin mining nation as early as 2017, leveraging its intensive mining infrastructure and low electrical energy prices to contribute upwards of 75% of the worldwide hash price at one level.

But, the nation would later crack down on the business.

China’s Crypto Crackdown

In 2019, the Nationwide Improvement and Reform Fee of China (NDRC) signaled its intention to ban cryptocurrency mining by releasing a draft legislation categorizing it as an “undesirable business.”

Two years later, at the least 4 Chinese language provinces started shutting down mining operations. These crackdowns intensified amid issues over extreme power consumption.

Towards the tip of 2021, the federal government declared all crypto-related transactions unlawful, additional solidifying the ban and prohibiting abroad exchanges from serving Chinese language residents.

Nevertheless, China possesses a confirmed capability to regulate to geopolitical shifts that might jeopardize its financial dominance, and the present setting might current such a problem.

Has Bitcoin Mining in China Really Stopped?

Even with China’s official stance towards crypto, mining exercise has not stopped inside the area. In July 2024, Bitcoin environmental impression analyst Daniel Batten reported that the hashrate inside China presently accounts for roughly 15% of the worldwide complete.

“Regardless of the official ban, the infrastructure is already in place: from offshore mining to cross-border buying and selling hubs. With extra world momentum behind crypto adoption and the US taking the lead, China might discover itself incentivized to lean in additional strategically, even when unofficially,” Nic Puckrin, Co-founder of the Coin Bureau, instructed BeInCrypto.

China additionally has a geographical benefit over the US, particularly relating to technological developments.

Crypto mining, particularly for proof-of-work cryptocurrencies like Bitcoin, is determined by Software-Particular Built-in Circuit (ASIC) gear to deal with the required advanced calculations for validation and mining.

China’s place as a high exporter of crypto mining {hardware}, significantly to the US, offers it a possible benefit ought to it resolve to revive its mining sector.

The unfolding tariff dispute between the 2 nations provides a layer of uncertainty to the long-term price effectivity of US mining operations.

Puckrin believes that the mixture of commerce friction and the US’s invigorated push for crypto dominance is likely to be ample to make China rethink its place.

“It’s unlikely China will make a public U-turn on its crypto mining and buying and selling ban anytime quickly. Nevertheless, with US-based miners accounting for greater and better proportions of Bitcoin’s hashrate, China is sure to be paying consideration and could be quietly reassessing its stance,” Puckrin instructed BeInCrypto.

Nevertheless, China has methods past restarting its Bitcoin mining business to undermine the US’ dominance.

China’s Nuanced Method Past US Affect

Despite the fact that China opposes the widespread use of cryptocurrencies domestically, it might nonetheless see worth in digital property to counterbalance the US greenback’s world foreign money dominance.

A number of nations worldwide have both adopted or are contemplating central financial institution digital currencies (CBDCs) to strengthen their home currencies. China is on the forefront of those developments.

“Regardless of the ban on Bitcoin mining, China has actively participated in the digital asset house, by initiatives like CDBC analysis and the digital yuan, or e-CNY,” Wanchain CEO Temujin Louie instructed BeInCrypto.

In reality, China’s efforts to create a digital yuan are partly pushed by its need to de-dollarize its financial system and reduce its dependence on the US greenback.

Louie additionally instructed that no matter transfer China makes, it gained’t solely base its resolution on what the US does or doesn’t do.

“As all the time, with China, a nuanced strategy is greatest. Any shifts in coverage will not be due to US tariffs. Moderately, China’s selections will be knowledgeable by world market traits and China’s personal home technique,” Louie added.

That stated, China’s selections about digital foreign money will, in flip, have an effect on how its place on crypto continues to develop.

“Weakening USD dominance, whether or not exacerbated or brought about by President Trump’s strategy to tariffs, might embolden China to be extra aggressive in [its] efforts to internationalise the yuan, together with the digital yuan, or e-CNY. Any change to China’s broader technique will probably be mirrored in [its] stance in the direction of crypto,” he concluded.

China’s exercise in different areas of worldwide commerce already proves how nuanced its coverage adjustments are usually.

May China’s Conflicting Crypto Insurance policies Sign a Change?

Except for its appreciation of digital currencies just like the e-CNY, China’s stance on crypto has already confirmed considerably contradictory. These discrepancies might gasoline the assumption that the nation may simply be prepared to revert—or at the least soften—its complete ban on mining.

A month in the past, funding agency VanEck confirmed that China and Russia –two nations significantly burdened by US sanctions– are reportedly settling a few of their power trades utilizing Bitcoin.

“With the US greenback more and more getting used as a political lever –significantly in tariffed economies– different nations are actively exploring options. Certainly, many nations world wide, together with China and Russia, are already utilizing Bitcoin instead for buying and selling in commodities and power, for instance. This development is barely going to speed up as digital property grow to be a extra distinguished a part of the worldwide financial system,” Puckrin instructed BeInCrypto.

In accordance with Puckrin’s evaluation of those indicators, China’s “shadow crypto financial system” is projected to increase this 12 months, which might lead to a reassertion of its energy. This resurgence could be primarily in response to de-dollarization efforts, fairly than a response to US dominance in mining.

We’ll doubtless see this exercise ramping up within the close to future, particularly as extra nations use crypto to bypass dollar-dominated methods,” he concluded.

It’s going to stay essential to interpret China’s intentions, particularly relating to cryptocurrency, by observing its actions fairly than relying solely on its official statements.