Picture supply: Rolls-Royce plc

After reinstating dividends earlier this yr, Rolls-Royce (LSE: RR.) shares have recaptured a few of their outdated appeal. And simply in time, as development seems to be petering out.

I’m now questioning whether or not 2025 can proceed to ship the identical distinctive returns of the previous two years. Up nearly 500% since November 2023, it’s exhausting to think about that sort of development might be repeated.

There’s been a notable dip within the UK market for the reason that October price range was introduced, additional fuelled by commerce fears following the US election.

Rolls-Royce seems to have taken a more durable hit than most. The inventory’s down round 8% for the reason that US election end result was introduced, whereas the FTSE 100‘s slipped lower than 1%. Fellow aerospace and defence big BAE Programs is down 3.5%.

Forecasts for 2025 and 2026

In August, Rolls-Royce shares soared 8.9% after the corporate introduced plans to payout 30% of underlying pretax revenue as dividends for 2024. It additional plans to extend this to between 30% and 40% thereafter.

The ultimate dividend for 2024’s anticipated to be 5p per share, representing a yield of round 1%. That is forecast to rise to 6p in 2025 and 8p in 2026, with yields of round 1.2% and 1.5% respectively.

Earnings per share (EPS) is predicted to come back in at 18p per share this yr, rising to 20p in 2025 and 23p in 2026.

With an expectation of additional earnings development, the corporate’s price-to-earnings (P/E) ratio will probably drop to 26.4 subsequent yr and 22.9 in 2026. Earnings are forecast to rise 22.4% in 2025 and 20.6% in 2026.

Mitigating components

There are, after all, some components that would derail these forecasts. Particularly, the escalating battle between Russia and Ukraine that’s now threatening wider Europe.

As a producer of engines for army plane, Rolls is intrinsically linked to the battle. Subsequently, defence spending has been a key driver of its development previously few years. But it surely’s a double-edged sword. The battle has led to a myriad of issues for European companies, from provide chain points to rising vitality prices. These prices may eat into earnings for the corporate.

A delay within the provide of supplies and parts utilized in its factories may impression manufacturing, decreasing gross sales and pushing up operational prices. And a major escalation within the battle may topple the financial system right into a recession, hurting its share value.

A sobering outlook

The reintroduction of dividends might have initially helped enhance the share value however the previous month has seen a 6.6% decline. Whereas there may be an expectation of average earnings development, I don’t anticipate to see the identical efficiency as earlier years.

If the corporate can efficiently navigate the challenges posed by the warfare in Ukraine, long-term prospects nonetheless look good. If dividends proceed to extend as forecast, they are going to add notable worth in a number of years time.

Nevertheless, I anticipate short-term returns might be disappointing in comparison with 2023 and 2024.

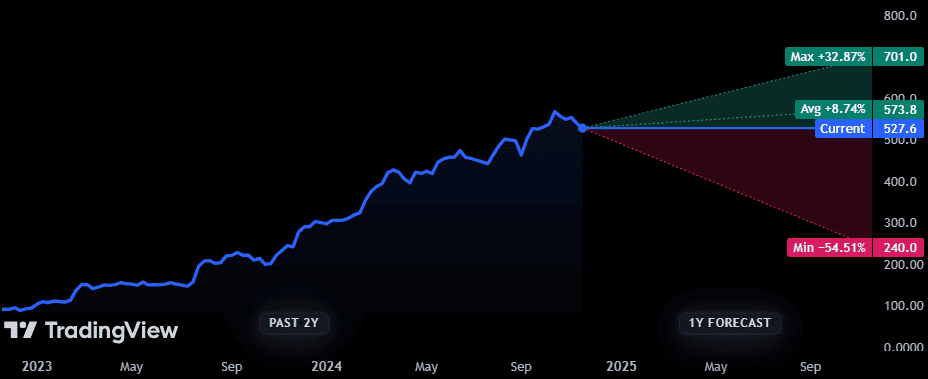

Whereas UBS, JPMorgan and Goldman Sachs all preserve Purchase rankings on the inventory, value forecasts aren’t precisely inspiring. The typical 12-month value goal is £5.73, an underwhelming 8.74% rise from present ranges.

I’d think about the shares in future, however proper now, they’re not excessive on my listing.