Picture supply: Getty Pictures

To contemplate whether or not the Barclays (LSE:BARC) share worth represents worth for cash, I believe it’s wise to make a comparability to different banks. Thankfully, the London Inventory Change repeatedly publishes knowledge that makes this attainable.

The numbers

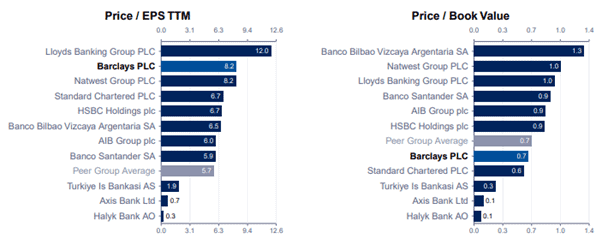

Based mostly on its outcomes for the previous 12 months, Barclays has a price-to-earnings ratio of 8.2. Of the FTSE 100’s 5 banks, this places it joint third within the league desk of ‘cheapness’.

Turning to its stability sheet, it has a price-to-book ratio of 0.7, implying that the worth of its property (much less liabilities) is 30% decrease than its present (18 July) inventory market valuation. Right here, it does higher than all of its friends besides Normal Chartered.

Revenue traders may take a look at the dividend yield to see what sort of return they may get. Though there are by no means any ensures relating to payouts, Barclays yield is decrease than all the Footsie’s banks besides, as soon as once more, Normal Chartered.

So with such a combined image, the place does this go away us?

What now?

We may take into account the 12-month worth targets of brokers to see what they suppose. In fact, these are simply forecasts however their common of 382.5p implies that Barclays shares are at present undervalued by 10%.

Encouragingly, none are recommending their purchasers promote the inventory.

Of the FTSE 100’s banks, solely NatWest Group does higher with a near-17% undervaluation.

Actually, the brokers reckon Normal Chartered’s shares are overpriced by 9%, HSBC’s pretty valued and that Lloyds Banking Group’s current market cap is 5% decrease than its true value.

Seeing the wooden for the timber

Given this confused backdrop, I believe it’s time to take a extra subjective view somewhat than rely totally on numbers.

In my view, there’s at all times going to be a necessity for banks. The entire new ones on the scene are comparatively small and none of them are near threatening the dominance of the UK’s ‘Large 5’.

However that doesn’t imply the business doesn’t face its challenges. There have been loads of banking crises over time with some notable collapses. Many have needed to shore up their stability sheets to make sure they proceed to satisfy their regulatory necessities.

And earnings within the sector will be unstable. Unhealthy loans are a selected downside throughout financial downturns.

However I believe the UK banking business — and Barclays particularly — is in fine condition.

The Financial institution of England’s newest Monetary Stability Report says the sector’s “properly capitalised, maintains sturdy liquidity and funding positions, and asset high quality stays sturdy.”

As for Barclays, its Q1 2025 outcomes confirmed a 26% improve in earnings per share in comparison with a yr earlier. It plans to extend its return on tangible fairness to over 12% by the tip of 2026. In 2024, it was 10.5%. With fairness of over £50bn, an enchancment of 1.5 share factors can have a huge effect.

Admittedly, it’s not sure this will probably be achieved. However with an skilled boss, sturdy model and sturdy stability sheet, I believe it may meet this goal. I due to this fact plan to carry on to my shares. And different traders may take into account including the inventory to their very own portfolios.