Picture supply: Getty Photos

One widespread strategy to worth shares is to take a look at their price-to-earnings (P/E) ratio. As a rule of thumb, the decrease it’s, the cheaper the share is, though there are a few necessary caveats to contemplate: the sustainability of the earnings and the agency’s debt each matter. In the meanwhile, one well-known FTSE 250 share sells for pennies and has a P/E ratio of simply 8.

So, is it a cut price I ought to purchase for my portfolio?

Nicely-known client model

The share in query is Dr Martens (LSE: DOCS).

With an iconic footwear model, massive buyer base, and distinctive place out there, I believe there’s a lot to love concerning the enterprise.

So, why is the FTSE 250 share promoting for pennies? (And why has it fallen 88% because it listed on the London inventory market simply three years in the past?)

The reply lies within the agency’s weak efficiency recently.

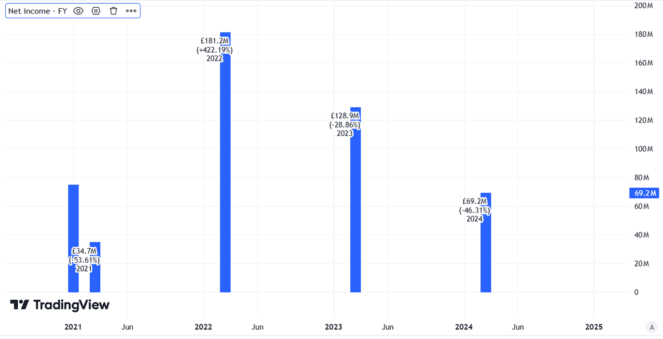

Take final 12 months for instance. Revenues fell by 12%. Revenue after tax crashed by 46%.

Created utilizing TradingView

In the meantime, internet debt rose by 24%. As I stated above, debt issues in the case of valuation as servicing and repaying it may possibly eat into earnings.

Potential for turnaround

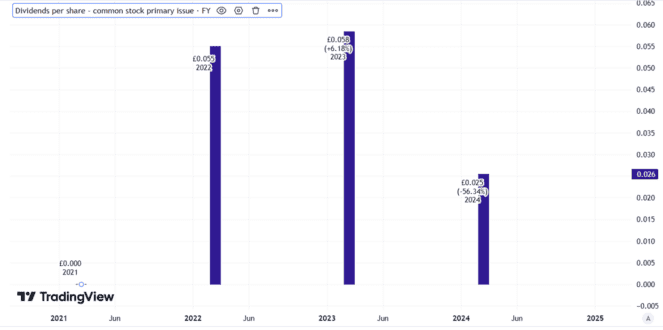

Nonetheless, whereas the corporate’s income after tax fell badly, it remained firmly within the black. It lower the dividend, however didn’t cancel it altogether.

Created utilizing TradingView

Weak US client demand was given as a key motive for final 12 months’s poor efficiency. However the enterprise introduced plans to handle that, together with rising advertising spend within the essential area.

The latest replace got here in July, when the corporate stated that buying and selling in its most up-to-date quarter had been consistent with expectations. I believe a giant take a look at will come this month, when Dr Martens is about to announce its interim outcomes.

In the event that they comprise constructive information about gross sales tendencies and prices, I reckon the present share value may become a cut price.

Nonetheless, the reverse may occur. If there are solely weak indicators of a turnaround (or none in any respect), the share value could fall additional. Dr Martens footwear aren’t low cost and US client spending stays pretty weak.

I’m not shopping for

I’m in no rush to purchase right here. The corporate’s big share value decline since itemizing factors to quite a few elements that concern me, from internet debt to the seeming fragility of the enterprise mannequin.

At finest, I believe the enterprise can begin to present proof of a turnaround and see the share value climb. However any such turnaround is unlikely to occur in a single day. So there’ll doubtless be time for me to purchase when proof of it comes, even when which means paying the next value than as we speak for the FTSE 250 share.

In the meantime, the dangers concern me. Dr Martens is a robust model however it’s a enterprise that has been battling sizeable challenges. These could proceed.