Picture supply: Getty Pictures

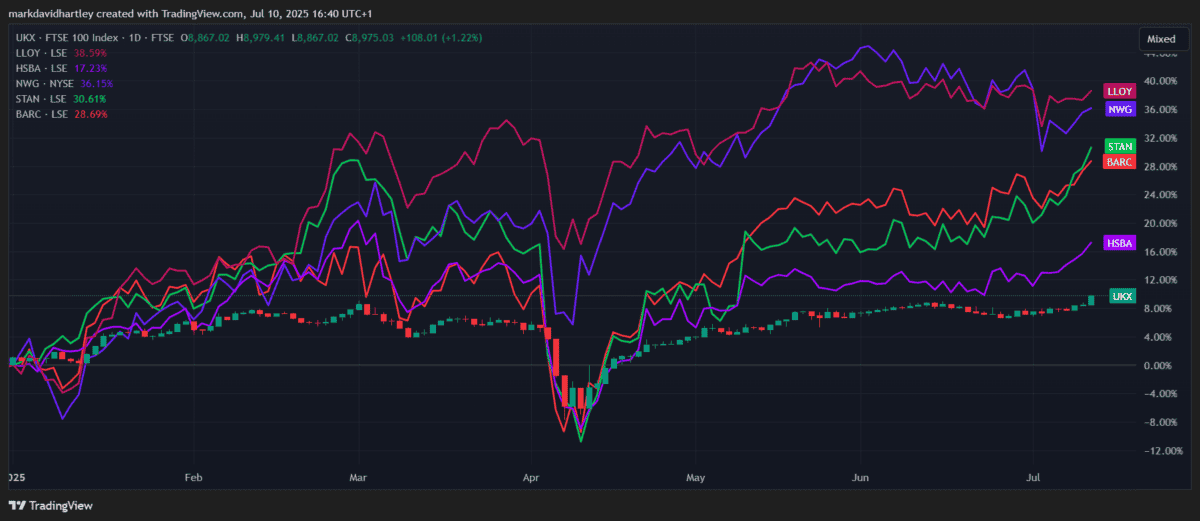

After a powerful 2024, the Barclays (LSE: BARC) share worth has struggled to maintain tempo to date in 2025. Among the many 5 main UK banks on the FTSE 100, Barclays is lagging most of its friends.

In contrast, Lloyds (LSE: LLOY) shares have been on a tear, surging virtually 40% year-to-date.

Trying on the broader UK financial system, varied elements proceed to have an effect on the banking business. Inflation stays sticky at round 3.4%, whereas the Financial institution of England holds rates of interest regular at 4.25%. Geopolitical dangers, from the continuing state of affairs in Jap Europe to political uncertainty within the US forward of the presidential election, are including to investor warning.

Nonetheless, increased charges have to date helped banks’ web curiosity revenue, although mortgage defaults are an ever-present fear in a fragile financial system.

In order we enter the second half of 2025, which of those banking heavyweights seems the higher worth purchase?

Barclays

Barclays is the second-largest UK financial institution by market capitalisation, at roughly £48bn, behind solely HSBC. It just lately made headlines as one in every of two closing bidders for Sabadell’s UK arm, TSB, going through off towards Santander.

Financially, Barclays has delivered spectacular numbers. Income grew by 9.8% yr on yr, whereas earnings development is excessive at 110%, helped by beneficial buying and selling circumstances in its funding banking arm. Its working margin stands at 31.5% and web margin at 20.4% — the very best among the many main UK lenders.

Valuation-wise, the Barclays share worth seems interesting. It trades at a price-to-earnings (P/E) ratio of simply 6 and a price-to-book (P/B) ratio of 0.8. That’s the bottom valuation within the sector. Nonetheless, its debt load of £176bn is sizeable, virtually triple its fairness base, and better than each Lloyds and NatWest. Whereas such gearing isn’t unusual for giant banks, it does enlarge dangers in a downturn.

The dividend yield is a modest 2.5%, although payouts have risen for 4 consecutive years, up 5% this yr. Dangers for Barclays embody publicity to world funding banking cycles, regulatory pressures, and the potential prices tied to increasing into new areas like TSB.

Lloyds

In the meantime, Lloyds’ numbers are extra modest, although arguably extra steady. Its working margin is 23.8% and web margin 15%. Return on fairness (ROE) is the weakest of the massive 5 banks at 8.7%, however Lloyds carries much less debt and has a stronger fairness place than Barclays.

The Lloyds share worth isn’t precisely costly, buying and selling on a P/E ratio of 8.8 and a P/B ratio slightly below break-even at 0.97. The winner right here is its dividend yield, which is much extra enticing at 4.2%. Plus, the payout’s risen for 4 straight years, climbing practically 15% yr on yr.

That stated, Lloyds does face potential headwinds, together with the potential for hefty fines linked to the continuing car finance mis-selling investigation. Plus, there’s the standard consumer-related dangers reminiscent of sensitivity to borrowing traits and a possible housing market slowdown.

My verdict

In my opinion, whereas the Barclays share worth suggests deeper worth, Lloyds’ superior dividend yield and stronger capital base make it the extra interesting long-term revenue play.

Regardless of the looming finance probe, it seems to me the higher possibility to contemplate as we navigate an unsure financial panorama in 2025.