Picture supply: Getty Photos

Thousands and thousands of us make investments for passive revenue. Nonetheless, most don’t know the place to begin. That’s particularly the case for these of us with out something saved.

So the place does an investor start, particularly with no nest egg at age 30? The reply, as ever, is deceptively easy. Begin placing apart a portion of wage every month.

Even when the quantity feels modest at first — maybe £100 or £200, no matter is manageable — the secret is consistency. By treating financial savings as a non-negotiable expense, akin to hire or council tax, a basis’s created for a future portfolio that works independently.

Compounding magic

However right here’s the true magic: compounding. That is the quiet drive that transforms small, common investments into substantial wealth over time. And that’s essential. As a result of we want substantial wealth as a way to earn a passive revenue.

For instance, if £200 is invested every month from age 30, and a median annual return of 5% is achieved, by age 65 the ensuing pot might be properly into six figures. Nonetheless, extra profitable traders might be able to common double-digit returns over the interval.

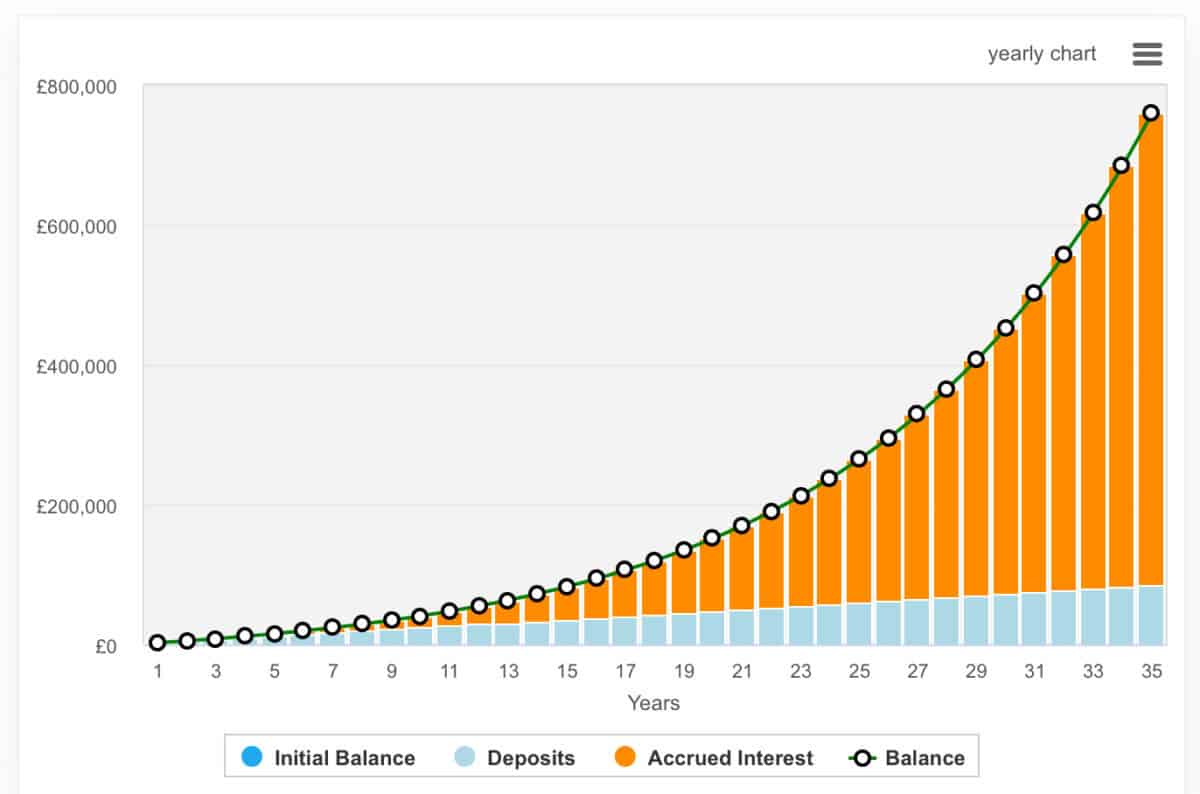

As we are able to see from the beneath chart, £200 a month may compound into almost £800,000 with 10% annualised development (which not everybody will be capable of obtain).

The sooner the beginning, the extra highly effective compounding turns into. Think about two hypothetical traders: one begins at 30, the opposite waits till 40 however doubles the month-to-month contribution. Regardless of placing in extra money, the late starter’s unlikely to catch up, just because the early fowl’s cash has had extra time to snowball.

Reinvesting dividends is one other essential lever. Relatively than taking payouts as money, dividends have to be ploughed again into holdings. This creates a virtuous cycle that accelerates development.

Above all, persistence is the best ally. The urge to tinker or chase fads might be ignored. Time and compounding do the heavy lifting.

The place to take a position?

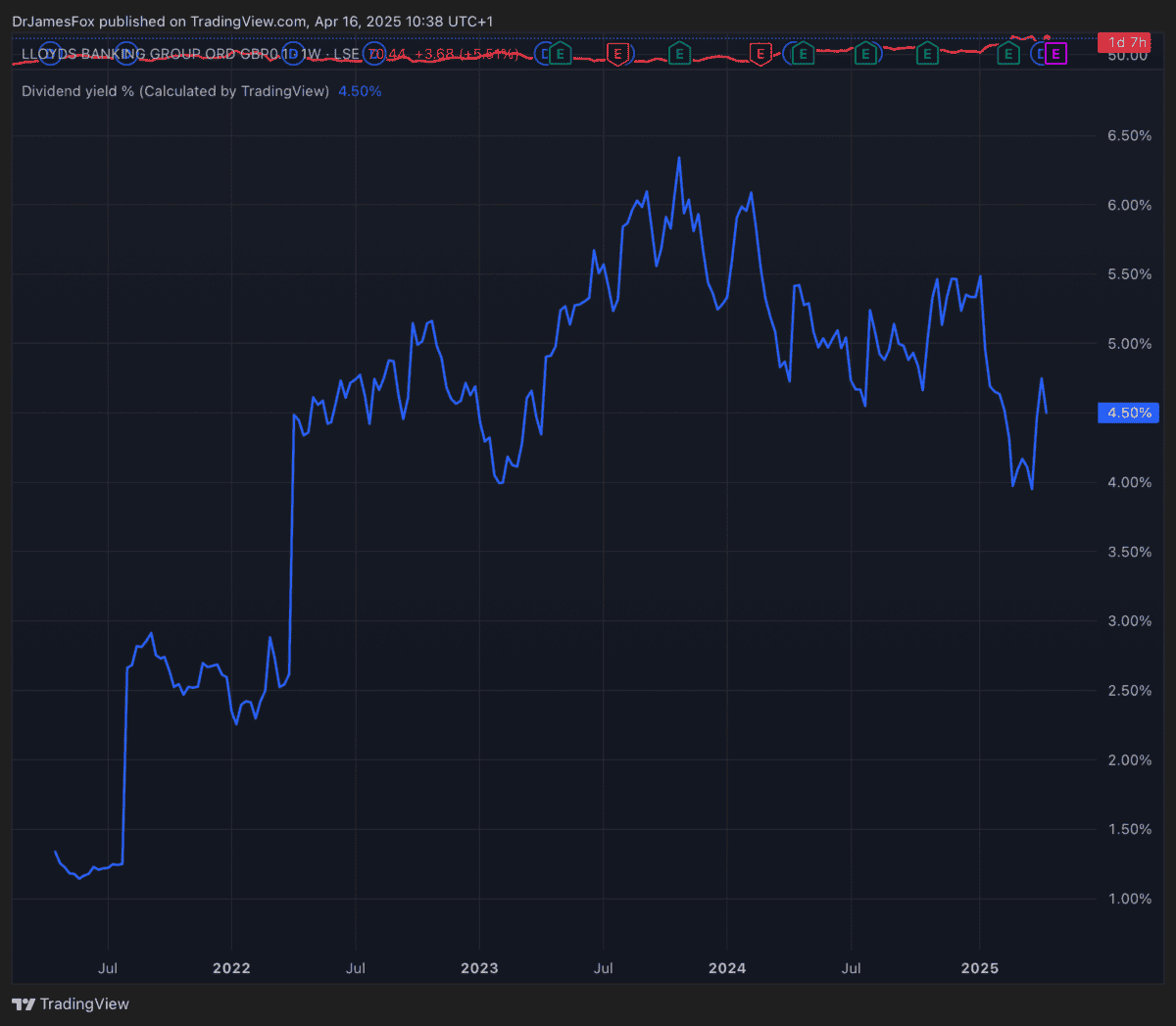

Let’s be sensible and never assume a ten% return. One possibility that might be thought of as a part of a various portfolio over the following 35 years is Lloyds (LSE:LLOY). The British lender presents a mix of revenue and worth for traders searching for publicity to the banking sector. Regardless of current volatility, together with the motor finance mis-selling probe, Lloyds is resilient with robust capital buffers and a progressive dividend coverage.

Wanting forward, Lloyds’ ahead earnings are forecast to enhance. Earnings per share (EPS) are projected at 6.5p in 2025, rising to eight.85p in 2026 and 10.68p in 2027.

As such, the ahead price-to-earnings (P/E) ratio’s anticipated to say no from 10.9 instances in 2025 to eight instances in 2026 and 6.6 instances in 2027. Dividends are additionally set to develop, with forecasts of three.44p per share in 2025, 4.07p in 2026, and 4.64p in 2027, translating to yields between 4.9% and 6.6%.

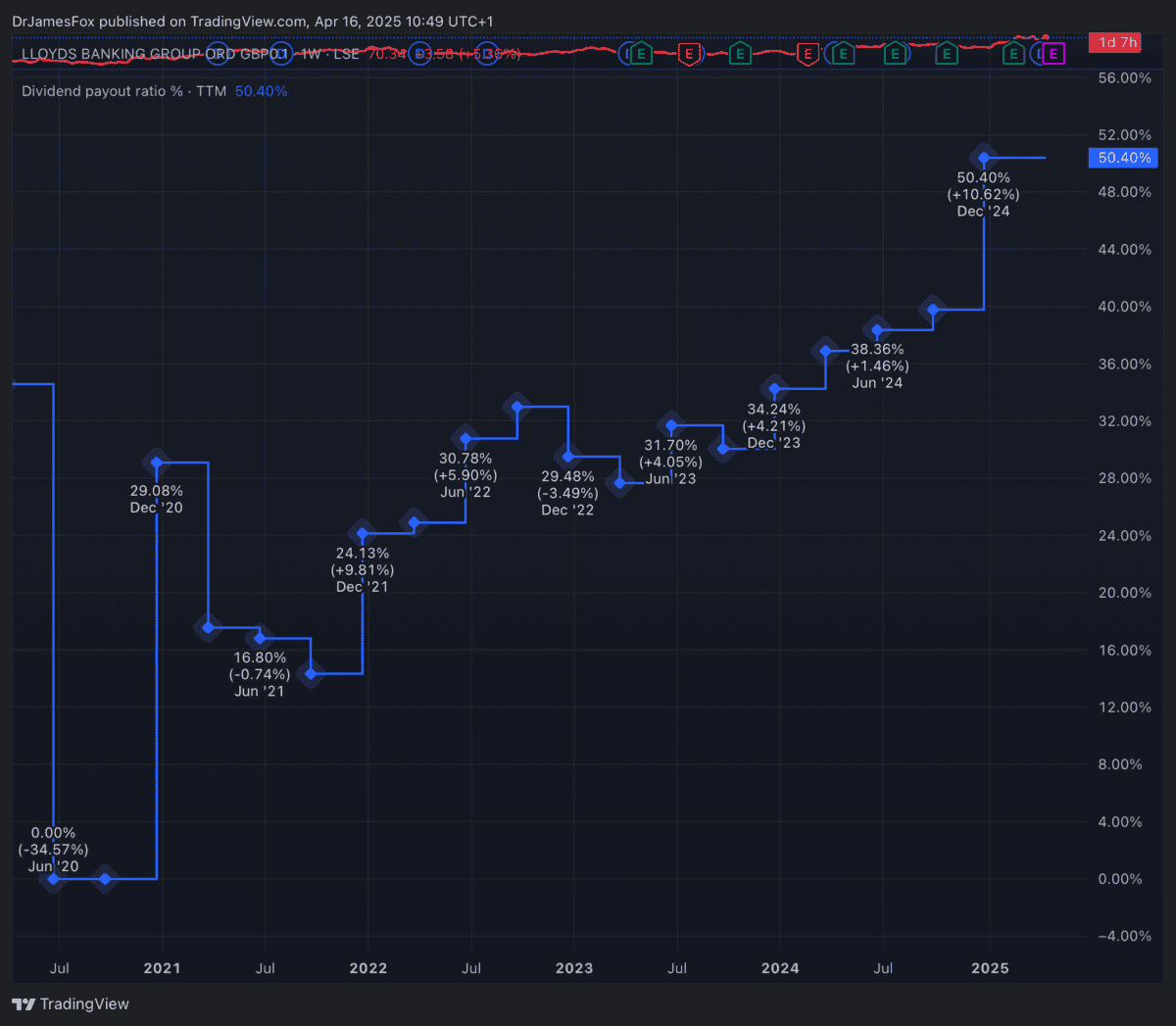

What’s extra, the payout ratio stay sustainable.

Dangers persist, in fact. The UK economic system may face a slowdown due to US tariffs, and this actually isn’t good for banks, which usually replicate the well being of the economic system. Nonetheless, it’s nonetheless an fascinating proposition. Personally, I’m simply holding on to my Lloyds shares, reasonably than shopping for extra, resulting from focus danger.