Key takeaways

- The Apple Card affords 3 % every day money again on Apple purchases and choose retailers, 2 % on Apple Pay purchases and 1 % on all different purchases.

- Your money again rewards are earned within the type of Each day Money, which you’ll select to gather within the Apple Money spot within the Pockets app or to deposit it into an Apple HYSA.

- You’ll be able to handle your Apple Card and the Each day Money straight out of your Apple Pockets.

The Apple Card* guarantees the chance to earn money again on every thing you purchase, together with Apple purchases, with out an annual price. Nonetheless, the money again you’ll earn with this card works otherwise than it does with a standard money again bank card.

With the Apple Card, you’ll earn Each day Money, which accrues every day (versus on the finish of a press release interval as is typical with rewards playing cards) and will be redeemed alongside some other funds you might have in your Apple Money account.

Earlier than you join the Apple Card, although, it helps to grasp how the rewards program works and the redemption choices you might be eligible for to determine for your self whether or not it’s value it.

Apple Card program fundamentals

The Apple Card comes with no annual price, no overseas transaction charges and no late charges, in addition to a tiered rewards program that provides you as much as 3 % again for some purchases. Right here’s how the rewards program works:

- 3 % again on items or providers bought straight from Apple, together with these from Apple on-line and retail shops, iTunes, Apple Music and different Apple-owned properties.

- 3 % Each day Money earned at choose retailers, which presently embody Duane Reade, Mobil, Panera Bread, Uber, Walgreens, Ace {Hardware}, Exxon, Nike, T-Cellular and Uber Eats.

- 2 % again on Apple Pay buy transactions

- 1 % again on every thing else

The Apple Card, issued by Goldman Sachs, was constructed to work at the side of Apple Pay. Nonetheless, in cases the place you’re procuring with an app or on a web site that doesn’t settle for Apple Pay, you’ll get a digital card quantity that operates within the Pockets app. This card can be a Mastercard, so it’s accepted wherever Mastercard is accepted world wide.

The Apple Card comes with a median variable rate of interest vary of 19.24 % to 29.49 %, however it will probably assist you pay much less in curiosity by estimating how a lot you’d pay on a particular buy and suggesting a cost quantity that can assist you pay down your stability quicker. As with most bank cards, you may keep away from curiosity altogether by paying your stability down in full every month.

Apple Card customers also can entry an unique high-yield financial savings account with Goldman Sachs. When you arrange an Apple Financial savings account, your Each day Money rewards will likely be robotically added to your financial savings account, which affords a 4.40 % APY. There aren’t any minimal deposit or stability necessities, and you may withdraw your rewards at any time with out paying a price.

That mentioned, the Apple Card is extra restricted than different bank cards for the reason that reward redemption choices are restricted — the cardboard, in spite of everything, is designed for Apple fanatics and the rewards are geared towards protecting you that manner.

How does the Apple Card’s money again work?

Once you rack up money again with the Apple Card, you’ll be rewarded within the type of Each day Money. For essentially the most half, the time period “Each day Money” is barely used to explain the amount of money again you’ve accrued in your rewards account. Not like different money again bank cards that award you as soon as monthly when your bank card assertion closes, Each day Money accrues on daily basis as you earn it.

As Each day Money accrues, it would robotically be added to your Apple Money account or Apple Financial savings account (if in case you have one). Apple Money is a part of Apple Pay that allows you to keep a money stability you need to use towards purchases or sending cash to buddies, amongst different choices. As an illustration, if you store with Apple Pay and have a stability in your Apple Money account, you need to use it to pay for purchases as an alternative of utilizing one other type of cost tied to your account.

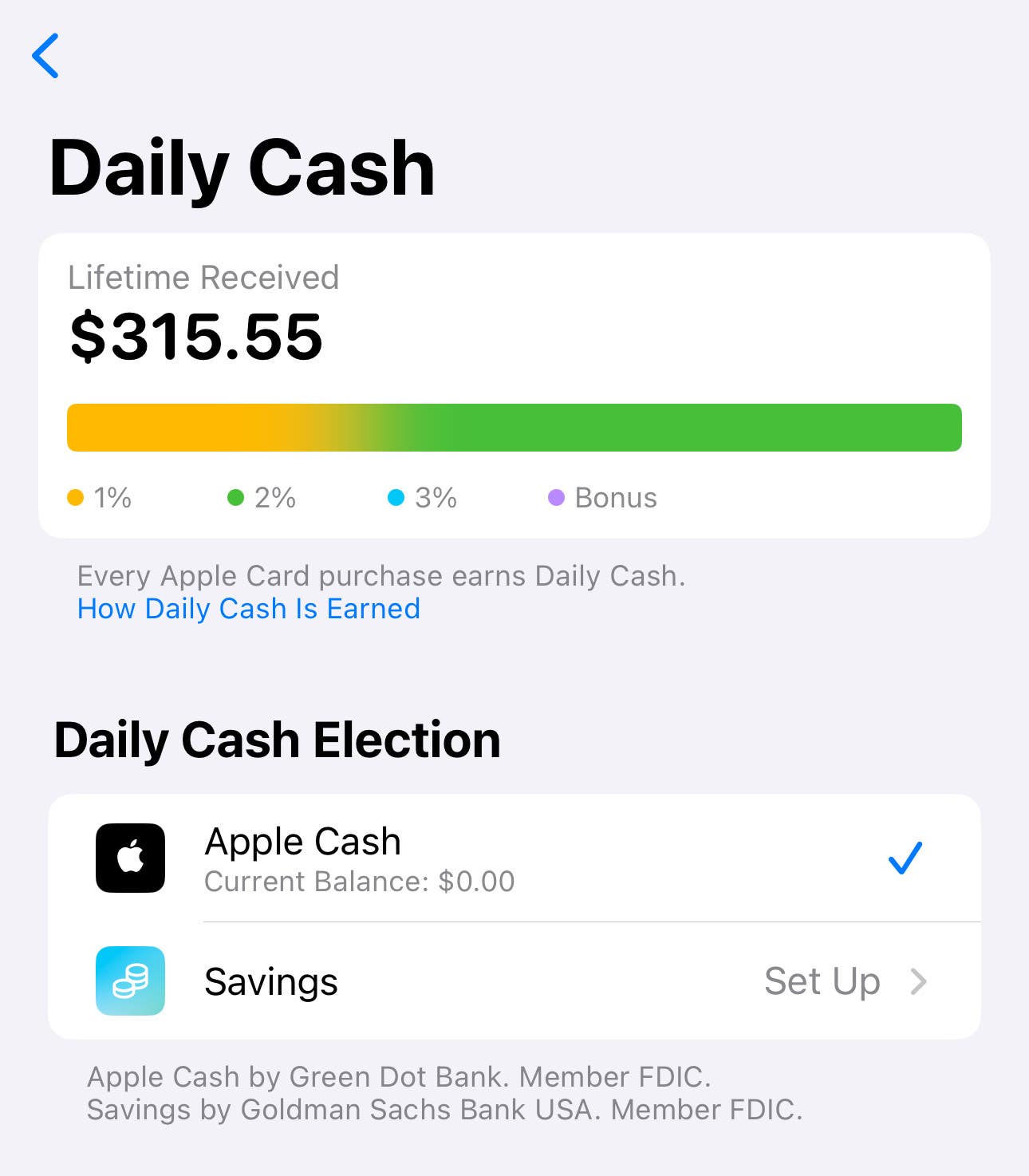

Easy methods to discover your Each day Money

Discovering your Each day Money is easy. Simply unlock your iPhone, open the Pockets app, and select your Apple Card. Then faucet on the three dots within the high proper nook and select Each day Money. That’s the place you may see how a lot Each day Money you’ve earned, the place it’s depositing to and any particular affords.

EXPAND

Your Each day Money doesn’t expire or lose worth, so that you’ll discover it in one of many three locations you may select to go away it:

- In your Goldman Sachs financial savings account.

- In your Apple Money, from which you’ll switch it to your checking account.

- Accumulating in your Apple Card (in case you haven’t arrange the opposite two choices).

In the event you didn’t arrange both of these choices, the Each day Money retains rising and will be redeemed as a press release credit score to your Apple Card, which counts as a cost.

Bankrate perception

It’s essential to notice that in case you select to deposit your Each day Money to Apple Money, that stability will get mixed with some other Apple Money you’ve acquired. For instance, if somebody despatched you $25 Apple Money to cowl their half of lunch and also you deposited $1 of Each day Money, you’ll see a stability of $26.

Easy methods to change the vacation spot of your Each day Money

Need to change the place your Each day Money will get despatched to? Take the identical steps as discovering your Each day Money and look beneath the Each day Money Election heading. So long as you might have the Financial savings or Apple Money arrange, you may simply faucet on which one you’d like to vary it to. It sometimes takes a minimum of one enterprise day in your choice to enter impact. The one you’ve chosen efficiently can have a blue checkmark subsequent to it.

EXPAND

In the event you elect to ship it to financial savings, you’ll earn curiosity in your stability. Nonetheless, if it’s set to contribute to your Apple Money stability, you need to use it to make purchases and ship cash to folks . Select which manner works finest in your functions and change it up anytime you need.

What are you able to redeem Apple Card’s Each day Money for?

You need to use your Each day Money rewards for:

- Shopping for gadgets by way of Apple Pay

- Sending cash to buddies

- Paying down your bank card stability

- Rising your financial savings in a high-yield Apple Financial savings account

Once you use your money again to make purchases by means of Apple Pay, the choices for redeeming your money again rewards are almost infinite since you need to use Apple Pay wherever it’s accepted — in grocery shops, boutiques, eating places and extra.

EXPAND

You may as well use Apple Money to make purchases in iTunes, Apple Music, the App Retailer, iCloud and Apple Information+.

Professionals and cons of Apple Card’s money again program

Whereas the Apple Card affords some beneficiant advantages and rewards, it’s not for everybody. The truth is, that you must be an Apple buyer to get essentially the most out of this money again bank card. To entry and use all of Apple Card’s options, you’ll want so as to add your Apple Card “to an eligible iPhone or iPad that you simply personal with the most recent model of iOS or iPadOS,” based on Apple.

To assist determine if the Apple Card’s rewards program is best for you, contemplate these extra professionals and cons:

Professionals

- As much as 3% rewards charge is larger than the charges many money again playing cards supply

- No hidden charges like annual price, late charges or overseas transaction charges

- Money again rewards accrue every day within the type of Each day Money

- Money again will be robotically deposited right into a high-yield financial savings account that earns 4.40 % APY

- Free laser-etched titanium card by request

Cons

- Should use Apple Pay for one of the best rewards charges to use

- No option to redeem your rewards straight for choices like present playing cards or journey

- Rewards combine along with your Apple Money stability, which is probably not very best in case you’re saving money again for a particular redemption

- No welcome supply or stability switch supply

Is Apple Card’s money again program value it?

In the event you’re a faithful Apple buyer who makes plenty of purchases with the model and already makes use of Apple Pay, then the Apple Card and its rewards program might match nicely with the way you already spend cash. However in case you don’t have an Apple machine and in addition don’t plan on getting one, this card and its rewards program will likely be of little worth to you.

On the finish of the day, the Apple Card is finest for customers who already function within the Apple universe and who principally wish to redeem their rewards towards purchases or for assertion credit or deposit their rewards in a high-yield financial savings account.

The underside line

Whereas the Apple Card will be very best for Apple fanatics, don’t overlook to check it with different choices on the market. There are nonetheless loads of high rewards bank cards that allow you to earn the same charge of rewards in common bonus classes. Plus, these playing cards’ rewards constructions received’t be tied to your cellular machine, and you’ll have extra choices for cashing in rewards.

As at all times, you need to evaluate bank card affords you’re contemplating when it comes to the rewards charges, advantages, welcome affords and charges earlier than you select a card.

*The details about the Apple Card has been collected independently by Bankrate. The cardboard particulars haven’t been reviewed or accredited by the cardboard issuer.